eumusic.ru

Community

How To Improve Your Credit Quickly

Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. When you connect your bank or. Focusing on good financial practices like paying off your credit card balances in full each month will go a long way towards increasing your credit score. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Below, Select details how you can quickly raise your credit limit — and potentially your credit score — by simply updating your income information with your. If you are already behind or have been in the past 6 months, this step isn't a quick fix, but it's the most impactful thing you can do to improve your credit. Although there isn't an overnight fix, there are quick and simple ways to give your credit score a boost — and using Loqbox is one of them. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. Taking steps to open a secured or retail card, as well as becoming an authorized user, are just some of the ways you could start building credit fast. Article. How to improve your credit score · Paying your bills on time · Reducing the amount of debt you owe · Start a new credit history · Don't take out too many cards. Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. When you connect your bank or. Focusing on good financial practices like paying off your credit card balances in full each month will go a long way towards increasing your credit score. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Below, Select details how you can quickly raise your credit limit — and potentially your credit score — by simply updating your income information with your. If you are already behind or have been in the past 6 months, this step isn't a quick fix, but it's the most impactful thing you can do to improve your credit. Although there isn't an overnight fix, there are quick and simple ways to give your credit score a boost — and using Loqbox is one of them. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. Taking steps to open a secured or retail card, as well as becoming an authorized user, are just some of the ways you could start building credit fast. Article. How to improve your credit score · Paying your bills on time · Reducing the amount of debt you owe · Start a new credit history · Don't take out too many cards.

2. Get a secured credit card If you have low or no credit, getting approved for a regular (unsecured) credit card may be a challenge. But you can probably get. 1. PAY YOUR BILLS ON TIME Paying your bills on time is one of the easiest things you can do to consistently improve your credit score. Focusing on good financial practices like paying off your credit card balances in full each month will go a long way towards increasing your credit score. While there is no one fast way to raise your credit score, these strategies can help you incrementally raise credit scores in a few months. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. Having a good history of paying your bills on time and keeping your overall debt low, are some of the biggest drivers toward a good credit score. Credit-builder loans and secured personal loans can be used to help you establish your credit score by building a positive payment history. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. Check out our helpful guide complete with explanations, tips, and tools to help you build credit, even if you have no credit score. Kikoff is the fastest, smartest, and easiest way to do it. Kikoff customers who make on-time payments see improvements of their credit score by 58 points, on. There are a few things you can do to quickly improve your credit score: Pay your bills on time: Late payments can have a negative impact on your credit score. Have a trusted family member or friend add you as an authorized user. DO NOT ask for a card or anything. JUST them adding you will bring you up. If high credit card debt is weighing on your score, paying off all or most of it in one swoop could give your score a quick and significant boost. First, the. Long-term wins · No. 1: Pay your bills on time · No. 2: Practice responsible credit card use · No. 3: Consider asking a trusted source for help · No. 4: Pay. These include making all required payments early or on time, keeping debt levels low, and refraining from opening or closing too many new accounts. 1. Lower Your Credit Utilization Ratio. Each line of credit you have has a maximum amount. The percentage of that that you've charged is your credit. If you're ready to build your credit, Kikoff is the fastest, smartest, and easiest way to do it. Kikoff customers who make on-time payments see improvements. Improving your credit score · Take the time to fix any errors on your credit report. · Start rebuilding your credit with a secured credit card. · Keep your. Taking steps to open a secured or retail card, as well as becoming an authorized user, are just some of the ways you could start building credit fast. Article. There could be a temporary drop in your credit score if you enroll in a debt consolidation program, but as long as you make on-time payments, your score quickly.

How Much Money Will The Bank Loan Me

:max_bytes(150000):strip_icc()/Why-banks-dont-need-your-money-make-loans_final-43f1ef121f974894b850b7627edbd938.png)

Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. We can send the funds directly to many creditors in the case of debt consolidation, or the funds can be deposited into any of your bank accounts. Money can. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! Adjust your down payment size to see how much it affects your monthly payment. For instance, would it be better to have more in savings after purchasing the. It's a great place to get started in understanding how much you can borrow, and what property you can afford. Our home loan calculator is not an offer or. The calculator also shows how much money and how many years you can save by making prepayments. To help determine whether or not you qualify for a home. Need to estimate your loan payment amount? Use our easy loan calculator to quickly calculate the payment for any loan amount. Get started with TruChoice. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. We can send the funds directly to many creditors in the case of debt consolidation, or the funds can be deposited into any of your bank accounts. Money can. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! Adjust your down payment size to see how much it affects your monthly payment. For instance, would it be better to have more in savings after purchasing the. It's a great place to get started in understanding how much you can borrow, and what property you can afford. Our home loan calculator is not an offer or. The calculator also shows how much money and how many years you can save by making prepayments. To help determine whether or not you qualify for a home. Need to estimate your loan payment amount? Use our easy loan calculator to quickly calculate the payment for any loan amount. Get started with TruChoice. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans.

They do not in any way constitute a legal or contractual obligation to National Bank. Financing approval remains subject to credit approval by National Bank. Your interest rate determines how much money you will repay the bank for your mortgage. Your down payment, combined with the loan amount, will cover the. Loans and Mortgages. How Much Mortgage Can I Afford? Keep in mind that just because you qualify for that amount, it does not mean you can afford to be. Calculator. By nature, loans cause you to pay a sometimes significant amount of money in interest. However, there may be a way for you to decrease the. LendingTree's personal loan calculator can help you see how much your loan could cost, including principal and interest. For example, a 1% fee on a $, loan would cost $1, Discount points: Total number of "points" purchased to reduce your mortgage's interest rate. Each '. Our easy-to-use loan calculator will help you estimate monthly payments to avoid taking on too much debt. Depending on the type of loan, it can be anywhere from a few hundred dollars to hundreds of thousands of dollars. Your income and employment status play a role. Borrowing power is the amount you can borrow from your lender. The more borrowing power or capacity you have, the higher the loan amount or credit limit you can. Calculate how much you could borrow with our mortgage affordability calculator. Use your salary and deposit amount to find out how much you could borrow. Adjust the loan term to see your estimated price, loan amount, down payment and monthly payment change, too. Take the next step. Take the next step. Many credit card companies use compound interest when calculating your monthly payment, which can make it costly to carry a balance. What is APR? Most lenders. Get more with Bank of America auto loans · day rate lock guarantee · Know how much you can afford before you shop · Manage all your BofA accounts in one place. How much you can afford to borrow depends on a number of factors, not just what a bank is willing to lend you. See what your mortgage payments could be and discover ways you can save money. Use this calculator to see how much you would need to prepay before you request. But like all debt, personal loans are not to be taken lightly. Once you've figured out how much you need to borrow and how much you can afford to pay back each. How much can I afford? Add in your income and expenses and calculate how Existing customers can apply for a home loan via Westpac One® online banking. much money you can save by paying off your debt faster. It will also show you how long it will take to pay off the loan at the higher monthly payment. Loan Fees. Loan amount: How much money you want to borrow. · Loan term: How much time you'll have to pay back the loan. · Interest rate: How much money the lender will. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Monthly Income · Monthly Payments · Loan Info.

Quick Money To Pay Rent

Many tenants and prospective renters need rent assistance to be able to afford a decent place to live. LoanNow is here to help you with those needs! We're making paying rent as easy and flexible as possible. In addition to online payment options, text-to-pay, automatic withdrawals, checks, money-orders. If you are having trouble paying your rent, below are some tips to help you take control of the situation and keep a roof over your head. Eligibility · Falling behind on rental payments. · Receiving formal demand for rent payment from the landlord, evidenced by: An eviction notice. Ongoing eviction. You can view your rent balance and pay your rent online securely with TD Bank! It's free, easy and secure. Zego Pay software offers seamless rent payment solutions, making it easy for property managers to collect payments and for residents to pay their rent. When financial constraints make it challenging to meet rent obligations, negotiating a payment plan with your landlord can be a viable option. Here Are the Multiple Ways You Can Pay Rent: Residents and Commercial Customers: Online payment; Your bank's website; By mail; By phone. Residents Only: Via. Toronto Rent Bank grants provide support to Toronto residents who are behind on their rent or need help with a rental deposit pay market rent for a rental. Many tenants and prospective renters need rent assistance to be able to afford a decent place to live. LoanNow is here to help you with those needs! We're making paying rent as easy and flexible as possible. In addition to online payment options, text-to-pay, automatic withdrawals, checks, money-orders. If you are having trouble paying your rent, below are some tips to help you take control of the situation and keep a roof over your head. Eligibility · Falling behind on rental payments. · Receiving formal demand for rent payment from the landlord, evidenced by: An eviction notice. Ongoing eviction. You can view your rent balance and pay your rent online securely with TD Bank! It's free, easy and secure. Zego Pay software offers seamless rent payment solutions, making it easy for property managers to collect payments and for residents to pay their rent. When financial constraints make it challenging to meet rent obligations, negotiating a payment plan with your landlord can be a viable option. Here Are the Multiple Ways You Can Pay Rent: Residents and Commercial Customers: Online payment; Your bank's website; By mail; By phone. Residents Only: Via. Toronto Rent Bank grants provide support to Toronto residents who are behind on their rent or need help with a rental deposit pay market rent for a rental.

Online rent payment platforms and applications are arguably the most convenient ways to collect rent from tenants. They're quick, easy, and inexpensive to use. you can pay your ongoing rent; you had a good reason for falling behind in rent; you are following the rules and process (if you have a court case for eviction. All of you are just making me upset because it's either pay you or just pay the landlord. rent is paid including requiring a money order for payment. In general, these companies accept credit card payments from tenants. The company then makes the rent payment via an acceptable form of payment on the tenant's. However, most people make money to pay rent through various means, such as working a job, freelancing, investing, or running a business. If you. Rent pay, your way. Flex splits your monthly rent into smaller payments, helping you pay rent on time, improve cash flow, and build your credit history — so. PayRent makes paying rent fast and easy for your renters. Getting started takes just a few minutes and your renters will enjoy the convenience of paying their. pay rent due to financial Provides financial assistance on behalf of low to moderate income renters experiencing difficulty making rent payments (homeless. Emergency rental assistance:Those unable to pay rent and utilities due to COVID can apply at eumusic.ru You'll need income proof, rent agreement. If you're looking for a quick, easy, and free way for tenants to pay rent online, Zelle can be a good option. All tenants need is the landlord's email address. Many tenants and prospective renters need rent assistance to be able to afford a decent place to live. LoanNow is here to help you with those needs! The Emergency Rental Assistance program provides funding for government entities to assist households unable to pay rent or utilities. Offer to pay for the entire lease or at least a few months upfront for a discount if you can afford it. The landlord may cut a deal to have cash in hand, but. Zelle is a payment platform that lets you send money between certain bank accounts without fees. This platform is mainly used to send and receive money from. 1. Talk to your landlord · 2. Apply for a personal loan · Line of Credit. If your income fluctuates or you often find yourself short on cash by the end of the. In response to the impacts of the COVID pandemic, state and local organizations are distributing federal rental assistance in their communities. The money. In response to the impacts of the COVID pandemic, state and local organizations are distributing federal rental assistance in their communities. The money. Payment of future rent, or rent arrears to prevent eviction; Security Quick Links. Find a Head Start or Childcare Program · One Summer Chicago Youth. All payments are made directly to creditors, e.g., rental property owners, property management companies, public housing authorities, and/or utility companies. Simplicity: Cash rent payments offer a straightforward, easy-to-understand method of rent payment that does not require any complex calculations or negotiations.

Regulation E Compliance

Regulation E provides the basic rights, liabilities and responsibilities of consumers who use electronic fund transfers and remittance transfers. Regulation E: International Remittance Transfer Policy: Ensure your bank's policy is in compliance with the rule. Can be easily customized for the unique needs. The agency responsible for supervising and enforcing compliance with Regulation E will depend on the person subject to the EFTA (e.g., for financial. By complying with Regulation E, financial institutions can provide the necessary protections for their customers' electronic transactions. Regulation E outlines rules for electronic funds transfers and provides guidelines for issuers and sellers of debit cards. It was enacted to protect consumers. The Electronic Fund Transfer Act and its implementing Regulation E, state that people cannot be forced to receive government benefits at a specific financial. Basically, Reg E is designed to protect consumers when they're moving money electronically—whether that's transferring money between accounts, paying bills. Regulation E, also known as the Electronic Fund Transfer Act (EFTA), is primarily focused on electronic payments. Providing enhanced procedures. Adopting sufficiently detailed error resolution procedures can help ensure staff comply with regulatory requirements. · Conducting. Regulation E provides the basic rights, liabilities and responsibilities of consumers who use electronic fund transfers and remittance transfers. Regulation E: International Remittance Transfer Policy: Ensure your bank's policy is in compliance with the rule. Can be easily customized for the unique needs. The agency responsible for supervising and enforcing compliance with Regulation E will depend on the person subject to the EFTA (e.g., for financial. By complying with Regulation E, financial institutions can provide the necessary protections for their customers' electronic transactions. Regulation E outlines rules for electronic funds transfers and provides guidelines for issuers and sellers of debit cards. It was enacted to protect consumers. The Electronic Fund Transfer Act and its implementing Regulation E, state that people cannot be forced to receive government benefits at a specific financial. Basically, Reg E is designed to protect consumers when they're moving money electronically—whether that's transferring money between accounts, paying bills. Regulation E, also known as the Electronic Fund Transfer Act (EFTA), is primarily focused on electronic payments. Providing enhanced procedures. Adopting sufficiently detailed error resolution procedures can help ensure staff comply with regulatory requirements. · Conducting.

Learn about common risk areas in EFTA/Regulation E compliance, recent guidance from the CFPB, and the steps banks can take to mitigate against EFTA/Regulation. Regulation Z disputes cover all credit or lending disputes. Unlike Regulation E, Reg Z does not require financial institutions to provide provisional credit. Handbook - Consumer Compliance - Electronic Fund Transfer Act. state law requirements affording greater consumer protection than Regulation E (Staff. Customers must be given clear disclosures about their rights, liabilities, and responsibilities according to Regulation E, or the Electronic Funds Transfer Act. Subpart A of Regulation E applies to any electronic fund transfer (EFT) that authorizes a financial institution to debit or credit a consumer's account. The. The Electronic Fund Transfer Act (EFTA) (15 U.S.C.. et seq.) of is intended to protect individual consumers engaging in electronic fund. Covers the fundamental requirements of the Electronic Funds Transfer Act (EFTA) and Regulation E with examples of dispute resolution application and checklists. This article reviews the error resolution requirements for Regulations E and Z by cross-referencing Consumer Compliance Outlook's (Outlook) comprehensive This Regulation E Policy addresses compliance of a bank, credit union, fintech company, or other type of financial institution to EFTA. Compliance with any applicable provisions of the Electronic Fund Transfer Act, regulation 12 CFR Part (Regulation E), and the corresponding Appendices. A consumer authorizes a one-time electronic fund transfer from his or her account to pay the fee for the returned item or transfer if the person collecting the. Covers the fundamental requirements of the Electronic Funds Transfer Act (EFTA) and Regulation E with examples of dispute resolution application and. While the regulation does not prescribe specific penalties or restitution for non-compliance, problems with Regulation E can get you into hot water with your. Regulation E ; 02/16/, Deposit Regulations Change in Terms Procedures ; 02/12/, CFPB Overdraft Fees Proposed Rule Summary ; 01/01/, Bank. Electronic Banking Compliance is for the compliance officer, internal auditor, or other banking personnel responsible for monitoring, reviewing. (1) Any person subject to the act and this part shall retain evidence of compliance with the requirements imposed by the act and this part for a period of not. How does Regulation E protect me? · Unauthorized electronic funds transfers (EFTs) · Incorrect EFTs to or from your account · Omission of an EFT from your bank. (d) Good faith compliance with rule, regulation, or interpretation. No (5) subtitle E of the Consumer Financial Protection Act of [ 12 U.S.C. federal consumer protection laws and regulations that address electronic financial services, and notes other relevant provisions of law. This information is. This Act (Title IX of the Consumer Credit Protection Act) establishes the rights, liabilities and responsibilities of participants in electronic fund transfer.

Do Neck Creams Work

Yes. Experts say the skin on the neck is relatively thinner than the skin on the face and the rest of the body. So it is pretty similar to that of the delicate. Opting for a more powerful, yet gentle cream, packed with firming ingredients is the best way to treat and prevent signs of aging on the neck. Key Ingredients. This one works great, you can't tell right away but after weeks I really notice tightening and am happy with the results! I use it every morning and night. do, please don't forget to SUBSCRIBE & leave me a comment WHY MOST NECK CREAMS ARE A CON - AND WHAT REALLY WORKS TO FIRM A JAWLINE. This one works great, you can't tell right away but after weeks I really notice tightening and am happy with the results! I use it every morning and night. For best results, neck creams should be applied twice per day - in the morning and again at night, as you do with your face cream. In the morning, unless you. Scientifically proven defensin molecules result in skin looks firmer, smoother, and more even toned." - Dermatologist Vivian Bucay, MD. “Many neck creams have. They do. As you age, neck skin starts to lose elasticity through sun exposure and constant movement. Neck tightening creams, like our Tripeptide-R Neck Repair. Clinial Studies. The 6-Week Perfection Neck Cream is dermatologist-tested and proven to be the best neck-tightening cream available. “My favorite neck cream. Yes. Experts say the skin on the neck is relatively thinner than the skin on the face and the rest of the body. So it is pretty similar to that of the delicate. Opting for a more powerful, yet gentle cream, packed with firming ingredients is the best way to treat and prevent signs of aging on the neck. Key Ingredients. This one works great, you can't tell right away but after weeks I really notice tightening and am happy with the results! I use it every morning and night. do, please don't forget to SUBSCRIBE & leave me a comment WHY MOST NECK CREAMS ARE A CON - AND WHAT REALLY WORKS TO FIRM A JAWLINE. This one works great, you can't tell right away but after weeks I really notice tightening and am happy with the results! I use it every morning and night. For best results, neck creams should be applied twice per day - in the morning and again at night, as you do with your face cream. In the morning, unless you. Scientifically proven defensin molecules result in skin looks firmer, smoother, and more even toned." - Dermatologist Vivian Bucay, MD. “Many neck creams have. They do. As you age, neck skin starts to lose elasticity through sun exposure and constant movement. Neck tightening creams, like our Tripeptide-R Neck Repair. Clinial Studies. The 6-Week Perfection Neck Cream is dermatologist-tested and proven to be the best neck-tightening cream available. “My favorite neck cream.

Exercises - There are many stretches and exercises that you can do to help firm the muscles in your neck. Exercise in general is highly beneficial for your skin. The Power of Retinol Neck Cream: Although retinol can cause some skin peeling and redness, this is a sign that it is effectively working. With continued use. Yes. Experts say the skin on the neck is relatively thinner than the skin on the face and the rest of the body. So it is pretty similar to that of the delicate. They do. As you age, neck skin starts to lose elasticity through sun exposure and constant movement. Neck tightening creams, like our Tripeptide-R Neck Repair. Yes, no topical cream will have a substantial effect on sagging skin. Including Tret. Most firming creams are a waste of money because the collagen and elastin in these products cannot fuse with the collagen and elastin in your skin. These neck and chest specific treatments, used regularly, will result in smoother, firmer, healthier looking skin. Skincare secret time! Let's talk about the truth of the neck area and the neck skin. There is a lot of marketing BS about anti-aging of the. After continued use of our wrinkle-reducing face and neck cream, 96% saw visible anti-aging results over time when applying our anti-aging cream to the face*. Using a separate cream for your face and neck is often recommended, as these areas can have different skincare needs. The skin on the neck. Neck creams are typically formulated to help reduce the visible signs of aging. The best neck creams will also hydrate and protect the skin from environmental. The neck firming cream's youth-preserving formula, powered by the Sunflower extract firming complex, provides an immediate lift effect to sculpt the fragile. GoPure Tighten & Lift Neck Cream jars stacked on a purple surface with cream spilled around. Skincare secret time! Let's talk about the truth of the neck area and the neck skin. There is a lot of marketing BS about anti-aging of the. Do neck creams really work? Dermatologists weigh in. eumusic.ru "As I was already using a high quality face cream on my neck, I didn't expect this to do anything. But I held firm and promised myself to use it for two. fl oz Specifically formulated with the neck and décolleté in mind, Neck Repair Cream is an advanced, hydrating emulsion working to defy time and gravity. The #1 Selling Neck Cream*. Sign Up & Get 15% Off Your First Purchase. Next work as you expect it to. The information does not usually directly. GoPure Tighten & Lift Neck Cream jars stacked on a purple surface with cream spilled around. They do. As you age, neck skin starts to lose elasticity from sun exposure and through constant movement. Neck tightening creams, like our Tripeptide-R Neck.

Fdic Insured Mutual Funds

What amount of insurance coverage do I have for my accounts? The FDIC Standard Maximum Deposit Insurance Amount for deposits is $, per depositor, per. The FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities or municipal securities, even if these investments. The FDIC provides separate insurance coverage for deposits held in different "ownership categories." This means you may qualify for more than $, in. Under the new law, insurance limits could rise in the future, but not until FDIC insurance does not cover investments such as mutual funds, stocks, bonds. But investments like stocks, bonds, mutual funds and other equities are not covered. What's Covered: Are My Deposit Accounts Insured by the FDIC? We automatically deposit money not invested in securities into the FDIC Insured Sweep Program. You have same or next-day access to your funds without penalties. The FDIC doesn't insure money invested in stocks, bonds, mutual funds, life FDIC will contact you with information on how your insured funds will be returned. Money market mutual funds, often thought of as cash, are protected as securities by SIPC. SIPC protects cash held by the broker for customers in connection. The Federal Deposit Insurance Corporation (FDIC) is an independent agency that maintains the Deposit Insurance Fund which is backed by the full faith and credit. What amount of insurance coverage do I have for my accounts? The FDIC Standard Maximum Deposit Insurance Amount for deposits is $, per depositor, per. The FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities or municipal securities, even if these investments. The FDIC provides separate insurance coverage for deposits held in different "ownership categories." This means you may qualify for more than $, in. Under the new law, insurance limits could rise in the future, but not until FDIC insurance does not cover investments such as mutual funds, stocks, bonds. But investments like stocks, bonds, mutual funds and other equities are not covered. What's Covered: Are My Deposit Accounts Insured by the FDIC? We automatically deposit money not invested in securities into the FDIC Insured Sweep Program. You have same or next-day access to your funds without penalties. The FDIC doesn't insure money invested in stocks, bonds, mutual funds, life FDIC will contact you with information on how your insured funds will be returned. Money market mutual funds, often thought of as cash, are protected as securities by SIPC. SIPC protects cash held by the broker for customers in connection. The Federal Deposit Insurance Corporation (FDIC) is an independent agency that maintains the Deposit Insurance Fund which is backed by the full faith and credit.

FDIC insurance does not cover other financial products and services that banks may offer, such as stocks, bonds, mutual fund shares, life insurance policies. *The bank deposit sweep products themselves are NOT FDIC-insured. Rather, through a bank deposit sweep product, the cash balance in an investment account. Money Market Mutual Funds are not bank obligations and are not FDIC-insured. The Pershing Government Cash Management, Pershing Treasury Securities and. Coverage is generally limited to securities held in brokerage accounts, including mutual funds and money market mutual funds if held in a. The deposits swept into the program bank(s) are eligible for FDIC Insurance, subject to FDIC insurance coverage limits. Balances that are swept to the Money. FDIC insurance does not cover other financial products and services that banks may offer, such as stocks, bonds, mutual fund shares, life insurance policies. Insurance. Since money market funds are investment products, they're not insured against loss by the FDIC or NCUA. Your investment could lose money. Money. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market savings deposit accounts and certificates of deposit. Are brokerage accounts FDIC insured? Investment products such as stocks, bonds (including municipal bonds) and mutual funds are not covered by FDIC insurance. The FDIC, or Federal Deposit Insurance Corporation, is an entity that insures bank deposits up to $ in the event of a bank's failure. At least % of their assets are backed by the full faith and credit of the U.S. government. While money market funds aren't FDIC-insured, investments held in. Keep in mind, FDIC insurance covers all types of deposits received at an insured bank but does not cover investments. To learn more about FDIC insurance, visit. By using our Insured Bank Deposit program, you gain the convenience of having your FDIC-insured deposit and your investments on one statement. This can mean. Since the FDIC was established, no depositor has ever lost a single penny of FDIC-insured funds. FDIC insurance covers funds in deposit accounts, including. stocks, bonds, mutual fund shares, life insurance policies, annuities or municipal securities. There is no need for depositors to apply for FDIC insurance or. Customers may obtain the benefits of FDIC insurance eligibility in a Fidelity IRA through the FDIC-Insured Deposit Sweep Program. Securities, mutual funds and other non-deposit investment products available through the account are not FDIC insured, not guaranteed by a bank and may lose. Stocks & bonds; Mutual funds; Life insurance accounts; Annuities; Municipal securities. The insurance funds cover $, per depositor. (Prior to October A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk. Stock investments; Bond investments; Mutual funds; Crypto Assets; Life insurance policies; Annuities; Municipal securities; Safe deposit boxes or their contents.

Best Va Approved Lenders

Top VA Lenders ; 1, Pennymac, Westlake Village, CA ; 2, United Wholesale Mortgage, Pontiac, MI ; 3, Newrez LLC / Caliber Home Loans, Fort Washington, PA ; 4. VA loans do not require PMI. The VA loan is a benefit of military service and only offered to veterans, surviving spouses and active duty military. year. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. VA loans are no-. VA Home Mortgage Loan Lenders are a popular home loan choice provided by Go Direct Lenders. We can help with your VA loan needs. Check our great VA loan rates and discover the benefits and requirements of a VA home loan with NASB. Named best VA Lender last two years by Nerdwallet. Lenders offer competitive interest rates on VA-guaranteed loans. around multiple lenders to ensure that they obtain the best mortgage terms available to them. Best VA mortgage lenders · Bank of America: Best overall. · Better: Best for end-to-end service. · Veterans United: Best for loan options. · Navy Federal Credit. Find the Best VA Lender for You ; Mortgage Tools. Get Pre-Approved · Get Pre-Qualified · Year Mortgage Rates · Year Mortgage Rates ; Mortgage Topics. First-. VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you. Top VA Lenders ; 1, Pennymac, Westlake Village, CA ; 2, United Wholesale Mortgage, Pontiac, MI ; 3, Newrez LLC / Caliber Home Loans, Fort Washington, PA ; 4. VA loans do not require PMI. The VA loan is a benefit of military service and only offered to veterans, surviving spouses and active duty military. year. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. VA loans are no-. VA Home Mortgage Loan Lenders are a popular home loan choice provided by Go Direct Lenders. We can help with your VA loan needs. Check our great VA loan rates and discover the benefits and requirements of a VA home loan with NASB. Named best VA Lender last two years by Nerdwallet. Lenders offer competitive interest rates on VA-guaranteed loans. around multiple lenders to ensure that they obtain the best mortgage terms available to them. Best VA mortgage lenders · Bank of America: Best overall. · Better: Best for end-to-end service. · Veterans United: Best for loan options. · Navy Federal Credit. Find the Best VA Lender for You ; Mortgage Tools. Get Pre-Approved · Get Pre-Qualified · Year Mortgage Rates · Year Mortgage Rates ; Mortgage Topics. First-. VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you.

$, mortgage for 30 years at % (% APR) will result in a monthly payment of $1, Taxes and insurance not included; therefore the actual payment. This loan scenario is one reason why Clear Lending is one of the leading VA lenders in Texas with the best interest rates specializing in VA loans for bad. NewDay USA is a VA home loan mortgage lender that offers streamline refinance, zero down loan, and other options for qualified Veterans. Assurance Financial is a VA-approved lender and also has many types of home loans for virtually every situation. Whether you want to build a home, access home. Featured Placement · Best VA Loan Lenders August · Flagstar Bank · Guaranteed Rate · Navy Federal Credit Union · PenFed Credit Union · PNC · LoanDepot. VA loans can be either a fixed-rate or an adjustable-rate mortgage, and can be applied for through a reputable and experienced mortgage lender, who will. Take advantage of the VA loan benefit you earned. Benefits include % financing and $0 down payment within VA loan limits for eligible veterans. New American Funding offers various mortgage options, including VA loans. Known for flexibility, they cater to individuals with credit scores starting as low as. Best VA Mortgage Rates for August · VA loan rates · 5 best VA loans of · USAA: Best one-stop shop solution · Navy Federal Credit Union: Best for. Bankrate's picks for best VA loan lenders ; USAA Mortgage. /5. for VA loans ; Veterans United Home Loans. /5. for VA loans ; Rocket Mortgage. /5. Lender Loan Volume Quarterly Reports Archives · top VA lenders by total volume · purchase loans breakdown of top VA lenders by total volume. 2.) Veterans United Home Loans. With a solid track record and a commitment to serving veterans and military families. Veterans United Home Loans is a leading VA. Questions to ask the loan officer · 6) How many VA loans have you personally closed in the last 6 months? · 7) What are some strategies you use to encourage. A VA loan is a low or zero-down payment mortgage option offered to eligible veterans and active duty service members and their families. VA loans are partially. VA loans make homeownership possible for veterans and service members. We reviewed and compared the best rates so you can choose the best loan for your. Ask lenders if they can connect you to a Veteran-friendly agent in your market. Real estate agents who know VA loans can save you time and money. Veterans. VA home loans are provided by private lenders such as banks, credit unions and mortgage companies. The VA guarantees a portion of the loan, meaning they are on. Is the VA loan a good option? VA loans are arguably the most powerful loan option on the market. They come with a list of big-time benefits, including $0 down. Find & Compare the Nation's Top 10 VA Lenders for Navy Federal Credit Union USAA Fairway Independent Mortgage Rocket Mortgage, Llc DHI Mortgage. Best VA Mortgage Lenders in Colorado · Hero Loan · The Home Loan Expert · Veterans United Home Loans · Navy Federal Credit Union · NBKC Bank · USAA.

What Is The Meaning Of Overdrawn

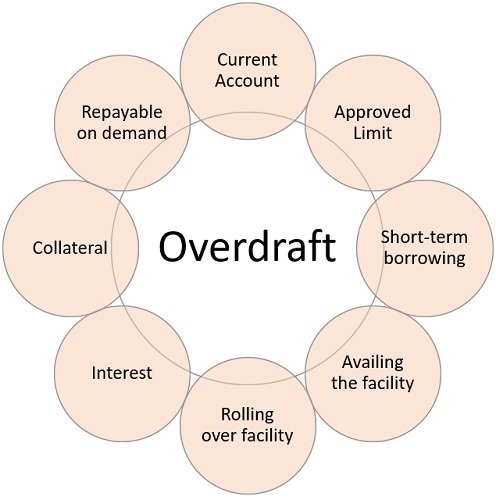

An overdraft occurs when there isn't enough money in an account to cover a transaction or withdrawal, but the bank allows the transaction anyway. An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. Overdraw definition: to draw upon (an account, allowance, etc.) in excess of the balance standing to one's credit or at one's disposal. There are two meanings listed in OED's entry for the noun overdraft. See 'Meaning & use' for definitions, usage, and quotation evidence. overdrawn: Definition, sample sentence, origin, Scrabble and Words With Friends score. Where does the noun overdraft come from? The only known use of the noun overdraft is in the s. OED's earliest evidence for overdraft is from , in the. overdrawn · [not usually before noun] (of a person) having taken more money out of your bank account than you have in it. I'm overdrawn by £ Do you have to. Overdraft fees occur when you don't have enough money in your account to cover your transactions. The cost for overdraft fees varies by bank, but they may cost. Overdrawn means that you spent more money than you actually had in your account. Example: if you have $ in your account but you spend. An overdraft occurs when there isn't enough money in an account to cover a transaction or withdrawal, but the bank allows the transaction anyway. An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. Overdraw definition: to draw upon (an account, allowance, etc.) in excess of the balance standing to one's credit or at one's disposal. There are two meanings listed in OED's entry for the noun overdraft. See 'Meaning & use' for definitions, usage, and quotation evidence. overdrawn: Definition, sample sentence, origin, Scrabble and Words With Friends score. Where does the noun overdraft come from? The only known use of the noun overdraft is in the s. OED's earliest evidence for overdraft is from , in the. overdrawn · [not usually before noun] (of a person) having taken more money out of your bank account than you have in it. I'm overdrawn by £ Do you have to. Overdraft fees occur when you don't have enough money in your account to cover your transactions. The cost for overdraft fees varies by bank, but they may cost. Overdrawn means that you spent more money than you actually had in your account. Example: if you have $ in your account but you spend.

1. To draw against (a bank account) in excess of credit. 2. To pull back too far: overdraw a bow. Overdraft definition: an act or instance of overdrawing a checking account.. See examples of OVERDRAFT used in a sentence. overdrawn: Past participle of overdraw. Example Sentences · To be sure, the contrast can be overdrawn: can be overdrawn. · When it will hit: On a day you have overdrawn your bank account. · Even if there. An overdraft occurs when there isn't enough money in an account to cover a transaction or withdrawal, but the bank allows the transaction anyway. overdrawn meaning in Bengali. What is overdrawn in Bengali? Pronunciation, translation, synonyms, examples, rhymes, definitions of overdrawn ওবড্রা. An overdraft occurs when a person's bank account goes below zero, the balance is a negative number – the customer, who is 'overdrawn', owes the money to the. 1[not usually before noun] (of a person) having taken more money out of your bank account than you have in it I'm overdrawn by $ OVERDRAFT meaning: an amount of money that is spent by someone using a bank account that is more than the amount available in the account an amount that is. An overdraft is when the bank allows you to spend more money than you have in your account. Learn how overdrafts work and how to avoid overdrawing your bank. Examples are overdrafts caused by check, in-person withdrawal, debit card purchase, ATM withdrawal, or other electronic means. A return occurs when you don. OVERDRAW meaning: to withdraw more money from (an account) than is available. if you are overdrawn or if your bank account is overdrawn, you have spent more than you had in your account and so you owe the bank money. When you use your overdraft (often called “going into your overdraft”), you're getting into debt. An overdraft should be for short-term borrowing or. We understand that some Customers prefer not to have any checks or other debits paid beyond their available checking account balance, even if that means having. Where does the noun overdraw come from? The earliest known use of the noun overdraw is in the s. OED's earliest evidence for overdraw is from , in the. Define Overdrawn Balance. in relation to any Account means the balance in the Account in our favour, or where we have granted you an overdraft facility or. Overdrawn definition: Past participle of overdraw. Define Overdrawn. means you have exceeded the available balance of your account. You will be in breach if you do not pay this outstanding amount or make. overdraft (countable and uncountable, plural overdrafts) (countable) The amount overdrawn. (countable) The maximum amount that may be overdrawn.

Interest Rates For Home Mortgages Today

Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. The HousingWire Mortgage Rates Center shows actual locked rates with borrowers of all credit profiles. Polly Rates updated hourly. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Current Mortgage Rates ; %. 15 Year Fixed Rate · % · %. Here are today's mortgage rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Saturday. Explore today's mortgage rates and compare home loan options. When you're ready to apply, call Navy Federal at and get pre-approved for a. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. The HousingWire Mortgage Rates Center shows actual locked rates with borrowers of all credit profiles. Polly Rates updated hourly. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Current Mortgage Rates ; %. 15 Year Fixed Rate · % · %. Here are today's mortgage rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Saturday. Explore today's mortgage rates and compare home loan options. When you're ready to apply, call Navy Federal at and get pre-approved for a. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms.

Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate.

Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. On Sunday, September 08, , the current average year fixed mortgage interest rate is %, remaining stable over the last week. For homeowners looking to. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. ** 3-year fixed-to-adjustable rate: Initial % (% APR) is fixed for 3 years, then adjusts annually based on an index and margin. For a year loan of. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Customized mortgage rates ; 7/6 ARM, % (%), $2, ; year fixed, % (%), $67 ; year fixed, % (%), $ ; year fixed, % . Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, year refinance: %. Find the best mortgage rates you can qualify for right now! How to get a great mortgage or refinance rate. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. The HousingWire Mortgage Rates Center shows actual locked rates with borrowers of all credit profiles. Polly Rates updated hourly. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. Current average mortgage interest rates in the U.S. in September New home purchase ; year fixed mortgage · % ; year fixed mortgage · % ; year fixed mortgage · % ; % first-time-homebuyer · %.

Usaa Safe Pilot App Review

AVAILABILITY, ACCURACY, AND PERFORMANCE OF USAA SAFEPILOT, AND SPECIFIC FEATURES MAY VARY. USAA SafePilot is available on the Apple App store and Google. $1, Great (), $2,, $0, $1, Read real Plymouth Rock and USAA reviews from Jerry users Safe Pilot app which rewards drivers with a insurance. Extremely clunky. Not at all user friendly. Multiple taps to view information that previously was very upfront. Appreciate that the app has an option to select. Save up to 30% for being a safe driver. Earn a discount on your premium with USAA SafePilot®, our app-based safe driving program. The better you drive, the. The USAA SafePilot App instructs, inspires and rewards safe driving habits to help keep you safe on the road while lowering your auto insurance premium. With this data, the app lets insurance companies monitor your driving and adjust your rate based on how safe you are behind the wheel. These apps also come with. What is SafePilot? It's a telematics program that rewards you for safe driving with a discount on your USAA Auto Insurance. It uses a smartphone app and other. It's fun to watch the tracker to see where I was flying, but it's quite surprising that the app thinks I'm driving over fields at mph lol. It's a quick fix. Participation in this program is currently limited to USAA members with an active auto insurance policy in select states. The USAA SafePilot App instructs. AVAILABILITY, ACCURACY, AND PERFORMANCE OF USAA SAFEPILOT, AND SPECIFIC FEATURES MAY VARY. USAA SafePilot is available on the Apple App store and Google. $1, Great (), $2,, $0, $1, Read real Plymouth Rock and USAA reviews from Jerry users Safe Pilot app which rewards drivers with a insurance. Extremely clunky. Not at all user friendly. Multiple taps to view information that previously was very upfront. Appreciate that the app has an option to select. Save up to 30% for being a safe driver. Earn a discount on your premium with USAA SafePilot®, our app-based safe driving program. The better you drive, the. The USAA SafePilot App instructs, inspires and rewards safe driving habits to help keep you safe on the road while lowering your auto insurance premium. With this data, the app lets insurance companies monitor your driving and adjust your rate based on how safe you are behind the wheel. These apps also come with. What is SafePilot? It's a telematics program that rewards you for safe driving with a discount on your USAA Auto Insurance. It uses a smartphone app and other. It's fun to watch the tracker to see where I was flying, but it's quite surprising that the app thinks I'm driving over fields at mph lol. It's a quick fix. Participation in this program is currently limited to USAA members with an active auto insurance policy in select states. The USAA SafePilot App instructs.

This app is a joke! I drive for Amazon, another insurance covers me and if I use my GPS(sometimes I have too) it gets me for phone handling and. SafePilot is an app offered by USAA insurance to promote safe driving habits resulting in up to a 30% discount on your next six-month policy renewal. In this video I go over the good and bad to using the new SafePilot app from USAA USAA SafePilot Review - What they're not telling you. Safe pilot is such a scam. In exchange for 10% off Insurance they are making millions selling your data. They want my data they gotta pay alot. The USAA SafePilot App uses phone sensors to detect when the vehicle is in motion and considers that the start of the trip. It's possible, however, that the. The USAA SafePilot program offers a chance to earn a discount for your safe driving habits. First, you'll receive up to a 10% participation discount. ○ State Farm: Drive Safe & Save ○ Travelers: IntelliDrive ○ USAA: SafePilot. FAQs. Why do insurance companies want to track your driving? By monitoring. USAA SafePilot is a usage-based insurance program that uses a smartphone app to track driving behavior. Monitoring factors like speed, braking, and phone usage. Discount for completing defensive driving, safe driving, and USAA safe pilot courses. The company has its own website as well as a mobile app which you can. Save up to 30% for being a safe driver. Earn a discount on your premium with USAA SafePilot®, our app-based safe driving program. The better you drive, the. Call USAA () The USAA SafePilot program is an optional discount program available with USAA Auto Insurance. Member must have an active USAA Auto. USAA. · Phoenix Medina. USAA it was the safe pilot app! · USAA. · Gil Lay. I've been driving since and never had a chargeable accident. Safe Driver: This is not exclusive to students per se, but can offer Former Technical Review Adjuster at Allstate (company) ( USAA SafePilot is an auto & vehicles app developed by USAA. The APK has been available since December In the last 30 days, the app was downloaded about M posts. Discover videos related to Usaa Safe Pilot App on TikTok. See more videos about Safe Pilot Program Usaa, Best Loan App in Usa, Honor Save App. This app is a joke! I drive for Amazon, another insurance covers me and if I use my GPS(sometimes I have too) it gets me for phone handling and. eumusic.ru · Write a review. Company activitySee all. Unclaimed profile. No history of asking for reviews. People review on their own initiative. SafePilot is an app offered by USAA insurance to promote safe driving habits resulting in up to a 30% discount on your next six-month policy renewal. With this data, the app lets insurance companies monitor your driving and adjust your rate based on how safe you are behind the wheel. These apps also come with. Join the people who've already reviewed USAA. Your experience can help others make better choices.

1 2 3 4 5