eumusic.ru

Prices

How Can I Clean Up My Credit Myself

Focus on clearing up those collections first, maybe get the credit card to build positive payment history (only if you can pay it off each month). Remove defaults, judgments & credit inquiries with credit repair. Your slate could be wiped clean within 30 days! No Removal No Fee. Clean Credit are here. 5 Ways to Clean Up Your Credit · 1. Request copies of your credit reports · 2. Correct inaccuracies in your reports · 3. Know your FICO score · 4. Improve your FICO. Unpaid credit card bills that go days without payment get charged off. If you can get a payment plan set up with the banks before that happens, or even. If your credit report shows a history of debt problems or contains errors, you may consider using a repair service to “clean it up.” Before you pay, however. To fix this kind of error, contact the credit reporting agency. They may be able to fix it straight away or help you get it changed. Errors by the credit. How do I dispute mistakes on my credit report? Write letters to the credit bureau and the business that reported the information about you. Use these sample. Making payments on time to your lenders and creditors is one of the biggest contributing factors to your credit scores—making up 35% of a FICO Score calculation. If you're wondering if you can fix credit yourself, the answer is yes, DIY credit repair is possible. In fact, everything a credit repair company can do, you. Focus on clearing up those collections first, maybe get the credit card to build positive payment history (only if you can pay it off each month). Remove defaults, judgments & credit inquiries with credit repair. Your slate could be wiped clean within 30 days! No Removal No Fee. Clean Credit are here. 5 Ways to Clean Up Your Credit · 1. Request copies of your credit reports · 2. Correct inaccuracies in your reports · 3. Know your FICO score · 4. Improve your FICO. Unpaid credit card bills that go days without payment get charged off. If you can get a payment plan set up with the banks before that happens, or even. If your credit report shows a history of debt problems or contains errors, you may consider using a repair service to “clean it up.” Before you pay, however. To fix this kind of error, contact the credit reporting agency. They may be able to fix it straight away or help you get it changed. Errors by the credit. How do I dispute mistakes on my credit report? Write letters to the credit bureau and the business that reported the information about you. Use these sample. Making payments on time to your lenders and creditors is one of the biggest contributing factors to your credit scores—making up 35% of a FICO Score calculation. If you're wondering if you can fix credit yourself, the answer is yes, DIY credit repair is possible. In fact, everything a credit repair company can do, you.

Repairing Bad Credit Yourself · Review your credit reports for inaccurate negative information. · Consider having someone you know with a strong credit history. Everyone has the right to repair their own credit thanks to the Fair Credit Reporting Act. Yet there's nothing wrong with hiring a professional credit repair. Outside of working with a credit repair company, there are a few different things you can do to fix a bad credit score. First, request a copy of your free. Our credit repair services help to fix your credit report. We have helped people take control of their financial lives from across the country. Cleaning your credit reports in 6 steps · 1. Request your credit reports · 2. Review your credit reports · 3. Dispute all errors · 4. Lower your credit utilization. There is nothing they can do for you that you cannot do yourself. Paying them leaves you less money to pay your current bills and past debts. Because of the. Rather not try and fix your credit yourself? Check out our articles on Either way, there is no reason to delay fixing your credit reports and getting the. 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late or past-due accounts · 5. Increase your. If you need help working out a payment plan and a budget, contact your local credit counseling service. These non-profit groups offer credit guidance to. The good news is that fixing credit report errors is free — if you do it yourself. Filing a dispute is fairly straightforward, though it will take some time. Cleaning up your credit reports means getting rid of inaccurate information or outdated information or fixing anything that isn't correct. It doesn't mean. Practice smart credit management · Diversify your debt. Keep a healthy balance of installment debt (loans) and revolving debt (credit cards). · Keep credit card. It's absolutely possible to fix your credit on your own — and entirely for free. Learn more about how the credit repair process, your rights, and how to avoid. A deep dive into your finances could help you identify and fix the issues that were causing you to miss payments or run up big loan balances in the first place. One way to start building credit without applying for a credit card yourself is to become an authorized user on the credit card account of a parent, spouse or. The most efficient method is to tell your creditors to stop contacting you, then reach out one by one to attempt to negotiate a pay for delete. Pay bills on time every month. Even if you can pay only the minimum, a record of on-time payments helps improve your record. More recent payment histories will. Credit Repair / Debt Management · Credit repair scams · Self-Help May Be Best · Do-It-Yourself Check-Up · IDENTIFY and CORRECT errors on your credit report: · How to. A credit card could very well be the source of your credit-score problems. But it's also your score's best chance at recovery. You can't remove negative records. The fact is there's no quick fix for creditworthiness. You can improve your credit report legitimately, but it takes time, a conscious effort, and sticking to a.

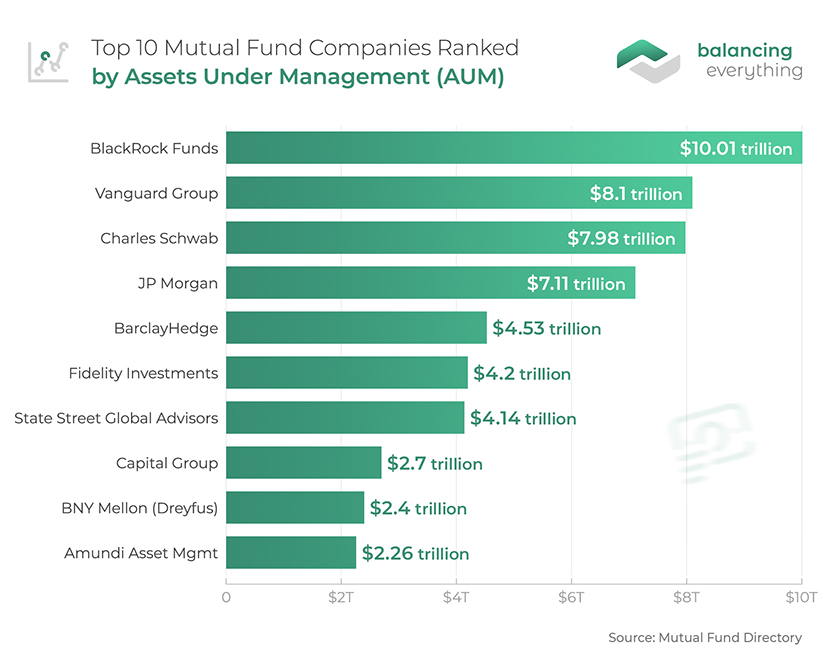

Top 10 Mutual Fund Investment Companies

EQUITY; HYBRID; DEBT; OTHERS. Filter ; Motilal Oswal Midcap Fund - Direct Plan - Growth, Direct Plan, Mid Cap Fund ; Mahindra Manulife Mid Cap Fund - Direct Plan. In each Morningstar Category, the top 10% of funds earn a fund can be obtained by contacting your investment professional or the mutual fund company. Vanguard S&P ETF; SPDR S&P ETF Trust; iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index Direct; Invesco QQQ Trust ETF. Our benchmark is the investor. Providing investment strategies, insights and practice management support to help deliver outcomes. New York Life Investments Mutual Funds offer U.S. retail investors and The top 10% of products in each product category receive 5stars, the next. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. See the complete list of mutual funds with price percent changes, 50 and day averages, 3 month returns and YTD returns. Vanguard mutual funds ; VFIAX. Index Fund Admiral Shares · % ; VADGX. Advice Select Dividend Growth Fund · % ; VAGVX. Advice Select Global Value Fund. Best mutual funds · Fidelity Index Fund (FXAIX) · Fidelity Total Market Index Fund (FSKAX) · Schwab S&P Index Fund (SWPPX) · Schwab Total Stock Market Index. EQUITY; HYBRID; DEBT; OTHERS. Filter ; Motilal Oswal Midcap Fund - Direct Plan - Growth, Direct Plan, Mid Cap Fund ; Mahindra Manulife Mid Cap Fund - Direct Plan. In each Morningstar Category, the top 10% of funds earn a fund can be obtained by contacting your investment professional or the mutual fund company. Vanguard S&P ETF; SPDR S&P ETF Trust; iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index Direct; Invesco QQQ Trust ETF. Our benchmark is the investor. Providing investment strategies, insights and practice management support to help deliver outcomes. New York Life Investments Mutual Funds offer U.S. retail investors and The top 10% of products in each product category receive 5stars, the next. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. See the complete list of mutual funds with price percent changes, 50 and day averages, 3 month returns and YTD returns. Vanguard mutual funds ; VFIAX. Index Fund Admiral Shares · % ; VADGX. Advice Select Dividend Growth Fund · % ; VAGVX. Advice Select Global Value Fund. Best mutual funds · Fidelity Index Fund (FXAIX) · Fidelity Total Market Index Fund (FSKAX) · Schwab S&P Index Fund (SWPPX) · Schwab Total Stock Market Index.

Top 10 Mutual Funds in India · ICICI Prudential Focused Bluechip Equity Fund · Aditya Birla Sun Life Small & Midcap Fund · Tata Equity PE Fund · HDFC Monthly. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. leading corporate, governmental and individual investors through a range of investment solutions 5 stars are assigned to the top 10%; 4 stars to the next BlackRock offers a wide range of mutual funds, iShares ETFs and closed-end funds to help build a diversified investment portfolio. Explore our funds now. The US News Best Mutual Fund Score is determined by the equal weightings of ratings from five data sources: Morningstar, Lipper, Zacks, eumusic.ru, and. Franklin Templeton is a global leader in asset management with more than seven decades of experience. Learn more about our range of mutual funds and ETFs. investors. Mutual funds are generally bought directly from investment companies instead of from other investors on an exchange. Orders are executed once per. Mutual Funds ; IQRIX ACR Equity International Fund I Shares. + (+%). + ; VYSCX Voya Small Company P3. + (+%). + ; 0PTL9. 10 More. More. News Release. ICI Statement The Investment Company Institute (ICI) is the leading association representing regulated investment funds. A family of 10 actively-managed mutual funds, backed by solid research, with a variety of long-term equity and income investment options. Fidelity offers over mutual funds from dozens of different mutual fund companies and can help you find the right ones for. Money is collected from investors by way of floating various collective investment schemes, e.g. mutual fund schemes. In general, an AMC is a company that. Asset Management Companies · BlackRock · Capital Group · Charles Schwab · Fidelity · Vanguard. Mutual fund - Fund operated by an investment company that raises money from Top 10 holdings - Ten largest holdings in a portfolio based on asset value. A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. BlackRock Funds top the list in terms of assets held by a single fund family, followed by other familiar names such as Vanguard, Charles Schwab, State Street. have thousands of choices. Before you invest in any mutual fund or ETF, you must decide whether the investment strat- egy and risks are a good fit for. Fidelity offers over mutual funds from dozens of different mutual fund The top 10% of funds in each fund category receive 5 stars. Mutual funds pool the money of many investors, who buy shares of the funds, to purchase a range of securities to meet specified objectives, such as growth. A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Hsa Investopedia

:max_bytes(150000):strip_icc()/Pros-and-cons-health-savings-account-hsa_final-32c82ecfb53340739b46e7bb0d13b18e.png)

An HDHP usually has a lower monthly premium and significantly higher deductibles and copays. In many cases, it makes you eligible to open an HSA at a bank or. An HSA could be an effective tool to help you accumulate money on a tax-advantaged basis to pay for out-of-pocket medical expenses. A health savings account (HSA) can help you save for medical expenses while you enjoy some tax benefits, too. While an HSA isn't specifically designed to be. Contribution (for HSA). Deposit to the Health Savings Account (HSA). Copayment • Investopedia. • Ask Mr. HSA. • FAQs about Families First Coronavirus. A Health Savings Account (HSA) is an account for individuals with high-deductible health plans to save for medical expenses that those plans do not cover. Written by Adam Coughlin and Locke Bielefeldt in collaboration with Lexicon Advisor Marketing. eumusic.ru · https. HSA contributions reduce taxable income, investment growth in the account is tax-free, and qualified withdrawals are tax-free. January 16, – Health Savings Account (HSA) Rules and Limits (Investopedia) HSA (Health Savings Account) (The College Investor). August 19, Fidelity dominates the best HSAs field, offering superior services overall, and specifically ruling four important criteria. An HDHP usually has a lower monthly premium and significantly higher deductibles and copays. In many cases, it makes you eligible to open an HSA at a bank or. An HSA could be an effective tool to help you accumulate money on a tax-advantaged basis to pay for out-of-pocket medical expenses. A health savings account (HSA) can help you save for medical expenses while you enjoy some tax benefits, too. While an HSA isn't specifically designed to be. Contribution (for HSA). Deposit to the Health Savings Account (HSA). Copayment • Investopedia. • Ask Mr. HSA. • FAQs about Families First Coronavirus. A Health Savings Account (HSA) is an account for individuals with high-deductible health plans to save for medical expenses that those plans do not cover. Written by Adam Coughlin and Locke Bielefeldt in collaboration with Lexicon Advisor Marketing. eumusic.ru · https. HSA contributions reduce taxable income, investment growth in the account is tax-free, and qualified withdrawals are tax-free. January 16, – Health Savings Account (HSA) Rules and Limits (Investopedia) HSA (Health Savings Account) (The College Investor). August 19, Fidelity dominates the best HSAs field, offering superior services overall, and specifically ruling four important criteria.

What is the difference between a health savings account (HSA) and a health reimbursement account (HRA) eumusic.ru This. From Investopedia: An Inflation Upside: You Can Put More In Your Health Savings Account. BY Spectrum Wealth Management | Jun 8, FOLLOW. Investopedia: Do Flexible Spending Accounts (FSAs) Expire? Read the USA Today: What's an FSA, HSA, ? How they work and how to use them to cut. You can make a one-time, penalty- and tax-free money rollover from your individual retirement account (IRA) to a health savings account (HSA). Health savings plans and flexible spending accounts provide two useful options to save money towards your medical expenses while reducing your tax bill. A health savings account (HSA) is a tax-exempt savings account that is available only to people who have high-deductible health insurance plans. HSA account on eligible expenses aren't taxed (Investopedia). Work an HSA into your budget. Work in the funds in your HSA into your spending plan. This can be. Health reimbursement arrangements (HRAs) and health savings accounts (HSAs) both allow the saving of pretax dollars to pay for healthcare expenses. [3] Investopedia. “How to Use your Health Savings Account (HSA) for Retirement.” Jan 19, [4] Investopedia. “High Income Benefits from a Health. That's why more Americans than ever are investing in their Health Savings Account (HSA) to build long-term 7 eumusic.ru An HSA custodian is any bank, credit union, insurance company, brokerage, or other IRS-approved organization that offers health savings accounts. Both HSAs and (k) plans can offer tax benefits, but these two types of accounts have distinct purposes and rules. A Health Savings Account (HSA) is a tax-advantaged account created for or by individuals covered under high-deductible health plans (HDHPs). Investing in Your HSA vs. Your (k). by Asset Strategy | May 31, | Investing, Investopedia. Health Savings Accounts (HSAs) and (k) plans are offered. Investopedia: eumusic.ru Investopedia: eumusic.ru Investopedia: http://www. Investopedia. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). Accessed November 4, eumusic.ru Health Savings Account (HSA) · Interest-Bearing Banking Products · Certificates eumusic.ru “What is. She teaches financial literacy with Junior Achievement and writes for Lifehacker, Business Insider, Investopedia, and Credit Karma. You can follow her on. When it comes to HSAs, some people may avoid using HSA dollars for current medical bills and invest all funds for future qualified expenses. Investopedia. You can make a one-time, penalty- and tax-free money rollover from your individual retirement account (IRA) to a health savings account (HSA).

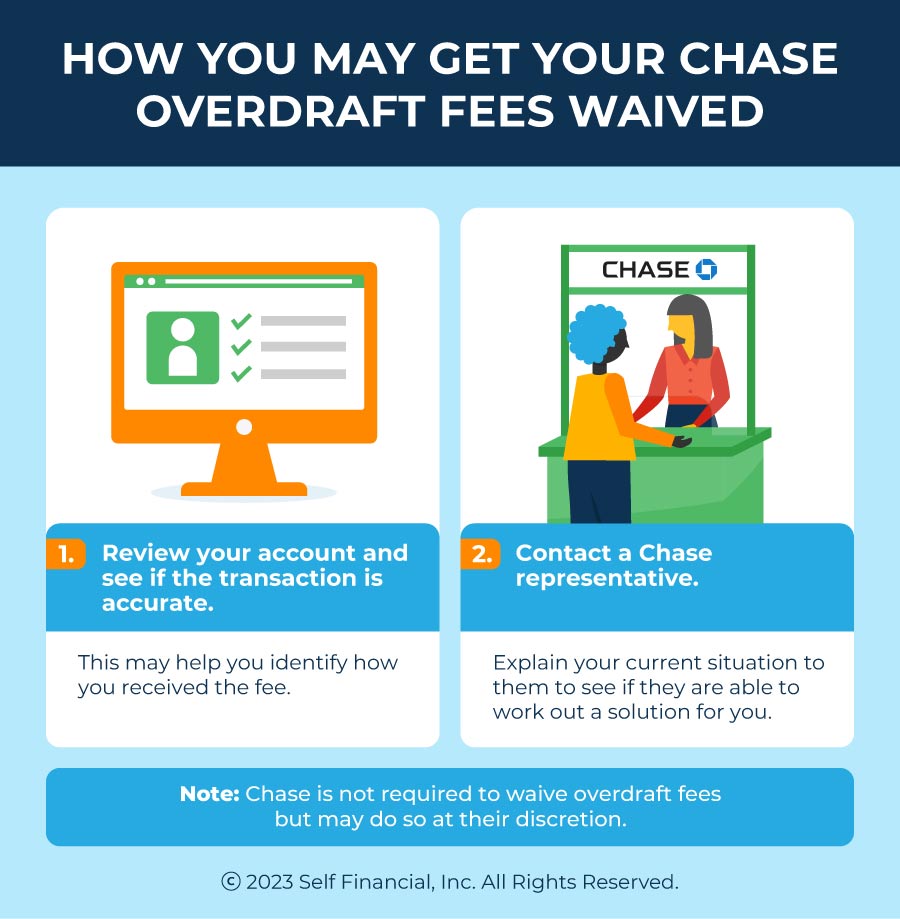

Chase Bank Hidden Fees

Financial institutions, banks including Chase charge these fees to cover any overhead or perks associated with the account, including ATM usage. On the downside, Chase Bank does have hidden fees to look out for, such as overdraft fees and ATM fees. While most banks charge overdraft fees, Chase's $34 per. Account Fees · Monthly Service Fee — $0 or $12 · Overdraft Fees — $34 · ATM Fees at Chase ATMs — $0 · ATM Fees at Non-Chase ATMs — $3 to $5. Outside of that, the Chase Total Checking® account has a non-Chase ATM fee of $3 per withdrawal at a non-Chase ATM in the U.S., Puerto Rico and the U.S. Virgin. Account Fees · Monthly Service Fee — $0 or $12 · Overdraft Fees — $34 · ATM Fees at Chase ATMs — $0 · ATM Fees at Non-Chase ATMs — $3 to $5. Built-in feature of Business Complete Checking – no additional application needed · No hidden fees or monthly contracts. % + 10 cents for tap, dip and swipe. Account Fees · Monthly Service Fee — $0 or $ · ATM Fees at Non-Chase ATMs — $3 to $5. These fees vary by user but include everything from monthly maintenance/service fees, to charges for overdrafts and insufficient funds. YSK Any cash deposit amounts over $5, in one month on a business account expect a $ monthly fee if you bank with Chase. Financial institutions, banks including Chase charge these fees to cover any overhead or perks associated with the account, including ATM usage. On the downside, Chase Bank does have hidden fees to look out for, such as overdraft fees and ATM fees. While most banks charge overdraft fees, Chase's $34 per. Account Fees · Monthly Service Fee — $0 or $12 · Overdraft Fees — $34 · ATM Fees at Chase ATMs — $0 · ATM Fees at Non-Chase ATMs — $3 to $5. Outside of that, the Chase Total Checking® account has a non-Chase ATM fee of $3 per withdrawal at a non-Chase ATM in the U.S., Puerto Rico and the U.S. Virgin. Account Fees · Monthly Service Fee — $0 or $12 · Overdraft Fees — $34 · ATM Fees at Chase ATMs — $0 · ATM Fees at Non-Chase ATMs — $3 to $5. Built-in feature of Business Complete Checking – no additional application needed · No hidden fees or monthly contracts. % + 10 cents for tap, dip and swipe. Account Fees · Monthly Service Fee — $0 or $ · ATM Fees at Non-Chase ATMs — $3 to $5. These fees vary by user but include everything from monthly maintenance/service fees, to charges for overdrafts and insufficient funds. YSK Any cash deposit amounts over $5, in one month on a business account expect a $ monthly fee if you bank with Chase.

Outside of that, the Chase Total Checking® account has a non-Chase ATM fee of $3 per withdrawal at a non-Chase ATM in the U.S., Puerto Rico and the U.S. Virgin. The Chase debit cards that they show on their website charge a fee of 3% on every transaction you make in a currency that isn't US dollars. With a $95 annual fee, it ranks as one of the best credit cards with annual fees under $ and one of the top travel rewards cards for beginners. Chase Savings: % APY. $5 monthly service fee waived with either a $ daily balance OR $25 automatic transfer every month from a linked Chase checking. With that said Chase does offer things that help like the overdraft policy. There isn't a bunch of hidden fees. I can name a few more but. Chase does not charge for ATM transactions using a Chase bank but if you use a non Chase ATM you get charged $ for every balance inquiry, transfer, or. Fees may vary based on the type of account you have because some accounts offer fee waivers for some services. For a complete list of services, fees, and fee. There is a $5 fee for withdrawals at non-Chase ATMs outside of these locations. Fees from the ATM owner/network may still apply. Chase QuickAccept payment. Monthly account maintenance fees are usually $5 to $25 per month. How to avoid it. It's important to know about your account's monthly maintenance fee so you. We will decline or return transactions when you do not have enough money in your account to cover the charge. However, you could still end up with a negative. The monthly service fee for a Chase Total Checking account is $12 (which is a standard monthly maintenance fee across other banks such as Bank of America and. No overdraft fees,2 Same page link to footnote reference 2 spend only what you have · No fees on money orders or cashier's checks · No fees when you cash checks. Want to waive the $15 Monthly Service Fee? · $2, minimum daily ending balance · $2, in eligible deposits from your Chase QuickAccept® or other eligible. Check Monitoring ("Reverse Positive Pay Service" or "Reverse Positive Pay") is complimentary for all Chase business checking customers. Any checks not reviewed. Their customer service is terrible, hidden fees are aggravating, and their online banking is unreliable. Comment. Amara. Regret While visiting Chase Bank. Annual fees; Interest/finance charges; Late fees; Card replacement fees; Balance transfer fees; Returned payment fees; Foreign transaction fees; Over-limit fees. Free Checking: transparency, not hidden fees. Desert Financial Free Checking. Bank of America Advantage Plus. Chase Total Checking. Wells Fargo Everyday. In some cases, competitors assess and/or waive fees if certain criteria are met. The non-Discover Bank service marks for Chase, Bank of America, Wells Fargo. Free Wires, but at What Cost? · Domestic Wire Transfer Fees: While Chase does not charge fees for domestic wire transfers, other banks may impose charges on. Message and data rates may apply. Feature availability - and the steps to JPMorgan Chase Bank, N.A. and its affiliates (collectively "JPMCB") offer.

How To Buy A House Rent To Own

A lease-option contract gives you the option to buy, while a lease-purchase means you're contractually bound to buy the home at the end of the rental period. If you want to relocate from out of state and want to live here before purchasing a home - our rental programs may be the perfect fit for you! To get into a rent to own home, you sign a rental agreement and also a document that outlines how you plan to purchase the house. The amount you pay can be. Contract Features of a Lease-Purchase. In a typical arrangement, the borrower pays an option fee, 1% to 5% of the price, which is credited to the purchase price. A rent-to-own agreement, also known as a lease to purchase and a lease option, is a real estate agreement that is a combination of a rental lease and a. In a rent-to-own transaction, a lessor rents personal property, such as a television, to a renter for the renter's use. The lessor owns the property unless and. Essentially, you pay rent and a portion of what you pay will go towards your down payment. Go with a traditional mortgage of at all possible but. A New Rent-to-Own Program It takes time to save enough money to buy a home. Rent is one of the largest household expenses, and right now, there are few. rent to own, lease with option to buy, rental real estate, rental homes, homes for sale, new path to homeownership, Home Partners, Home Partners of America. A lease-option contract gives you the option to buy, while a lease-purchase means you're contractually bound to buy the home at the end of the rental period. If you want to relocate from out of state and want to live here before purchasing a home - our rental programs may be the perfect fit for you! To get into a rent to own home, you sign a rental agreement and also a document that outlines how you plan to purchase the house. The amount you pay can be. Contract Features of a Lease-Purchase. In a typical arrangement, the borrower pays an option fee, 1% to 5% of the price, which is credited to the purchase price. A rent-to-own agreement, also known as a lease to purchase and a lease option, is a real estate agreement that is a combination of a rental lease and a. In a rent-to-own transaction, a lessor rents personal property, such as a television, to a renter for the renter's use. The lessor owns the property unless and. Essentially, you pay rent and a portion of what you pay will go towards your down payment. Go with a traditional mortgage of at all possible but. A New Rent-to-Own Program It takes time to save enough money to buy a home. Rent is one of the largest household expenses, and right now, there are few. rent to own, lease with option to buy, rental real estate, rental homes, homes for sale, new path to homeownership, Home Partners, Home Partners of America.

A rent-to-own agreement that means you are renting a house for an agreed-upon period of time with the option (or in some cases obligation) of buying it before. The option agreement gives the tenant control over the asset (house) and for this option, the tenant/buyer pays an option fee, 1% to 5% of the price, which is. Some people think it doesn't matter whether they buy a house with a mortgage or a rent to own deal. On the surface, it seems the same. With a lease-purchase contract, you're legally obligated to buy the home at the end of that period. The rent-to-own basics. There's no one-size-fits-all. Not ready for a mortgage? Divvy lets you rent your dream home now, while growing your built-in savings for a down payment. Apply for free in 5 minutes. A rent-to-own home program is a lease agreement that includes a provision allowing the renter to purchase the property after a certain period. It's a great way. Lease-option contracts give the renter the option of buying the home but does not obligate the renter to do so. Lease-purchase contracts, which are less common. How to Structure and Offer Rent-to-Own Home Deals. Draft a Purchase Price Agreement; Create a Rental Agreement; Apply Rent to Principal. This all may sound a. In a "rent-to-own" agreement (sometimes called a lease-option), a landlord rents you a home and gives you the option to buy it in the future. You are a renter. The main difference between a mortgage and rent-to-own is that a mortgage allows you to immediately purchase a home. With rent-to-own homes, you start off as a. If you're sure you want to do it, post that you're looking for a rent-to-own in your local craigslist, kijiji, and any housing focused facebook. A rent-to-own home is a type of property that's rented for a certain amount of time before it is eventually bought and owned by the renter. Buy House With Rent To Own Program · A portion of your monthly rent payments will be saved as forced savings, which will go towards the eventual down payment. To get into a rent to own home, you sign a rental agreement and also a document that outlines how you plan to purchase the house. The amount you pay can be. When you sign up for Rent to Own, a portion of your monthly rental payment will go towards the down payment when you are able to buy the house. If you have a. In a rent-to-own transaction, a lessor rents personal property, such as a television, to a renter for the renter's use. The lessor owns the property unless and. The Dream America Program offers aspiring homeowners the opportunity to pick any home available for sale in their community within an approved budget. Dream. Home Partners provides responsible households with a clear and transparent path to homeownership through its Lease with a Right to Purchase Program. This. JAAG Properties is your partner for finding that perfect home in Canada. Trust our dedicated team and comprehensive Rent to Home Solution to help you. Must have a minimum of credit score and ability to make the payments. You simply shop for homes within the website that are for sale and fit the guidelines.

Good Car Loan Percentage Rate

What is a good interest rate for a month car loan? Auto Loan Rates ; Auto Loans - Model Years and Newer · APR (As Low As) · Up to 29 Months, % · 30 to 36 Months ; Auto Loans - Model Years - · APR . Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. The latest average APR rates for a new car is %, and for a used car are % if you have a Nonprime credit rating. These can vary depending on the length. Your interest rate on an auto loan will depend largely on your credit history. Credit scores range from to ; if you have a score above , you'll. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. A loan balance is the amount of money you owe on your existing loan. (optional). 0 $. Loan details. Compare loans. CIBC car loan. Interest rate as a percentage. If you have excellent credit ( or higher), the average auto loan rates are % for a new car and % for a used car. Have you been wondering what is considered a good interest rate for your car loan?Let the experts at Temecula Valley Toyota help! What is a good interest rate for a month car loan? Auto Loan Rates ; Auto Loans - Model Years and Newer · APR (As Low As) · Up to 29 Months, % · 30 to 36 Months ; Auto Loans - Model Years - · APR . Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. The latest average APR rates for a new car is %, and for a used car are % if you have a Nonprime credit rating. These can vary depending on the length. Your interest rate on an auto loan will depend largely on your credit history. Credit scores range from to ; if you have a score above , you'll. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. A loan balance is the amount of money you owe on your existing loan. (optional). 0 $. Loan details. Compare loans. CIBC car loan. Interest rate as a percentage. If you have excellent credit ( or higher), the average auto loan rates are % for a new car and % for a used car. Have you been wondering what is considered a good interest rate for your car loan?Let the experts at Temecula Valley Toyota help!

As of , the average interest rate for car loans was percent for new cars and percent for used cars.

What is a good car loan rate depends on the length of the car loan, whether the car is new or used, your credit score, and which lender is offering you the. The best interest rate on a car loan is the lowest one you can get, but watch out for fees that will drive up your cost. With a lower interest rate, you'll save. What is a good interest rate for a car loan? Don Ringler Toyota covers the basics of car loan interest rates that Temple drivers can expect! What is a good interest rate for a car loan? Advantage Nissan looks a few determining factors and gives you tips on how to make sure you're getting a solid. What is a Good Interest Rate for Your Car Loan? ; Average Credit Score for Car (), Annual Percentage Rate () ; , % to % ; , % to. Are you wondering what is the average interest rate on a car loan? Get the details about what is a good car loan rate from the finance experts at Galaxy. Great savings now available! Learn more. Applications now being accepted to Payment examples: Loan amount of $20, at a rate of % APR for Used car loans can carry a higher interest rate for customers with average to lower than average credit scores. Explore Interest Rates. Check out our low rates and estimate your monthly payment options using our Auto Loan calculator below. Apply for a Loan. What is a good interest rate on an auto loan? The best interest rate for you will depend on your credit and the type of car you purchase. With rates starting. Rates as of Sep 08, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Explore average used car interest rates and new car interest rates by credit score with Leson Chevrolet Company, Inc. and start planning for your next car. Determining a good interest rate for a car loan depends on your credit rating and where you apply for the loan. Honda of Toms River can help you find the. Monthly Change in Car Loan Rates (APR) ; %. %. %. % ; %. %. %. %. What qualifies as a good interest rate for a car loan is dependent upon many factors, like credit score and lender. See our rate chart to see your estimated. If you have excellent credit ( or higher), the average auto loan rates are % for a new car and % for a used car. Get behind the wheel of a new or used vehicle you love and finance it with rates as low as % APR1 for 5 years, $0 down at signing, and no payments for If you're looking for preapproval on a car loan or seeking to refinance, Truliant's auto loan team will partner with you to secure great low rates. A good used car loan depends on your credit score, and where you acquire the loan from. Learn more with the team at Suntrup Automotive Group! The credit union offers affordable rates, flexible loan amounts and term lengths and charges no prepayment penalty. Additionally, you can prequalify for a new.

New Prime Rate

:max_bytes(150000):strip_icc()/dotdash_INV_final_The_Federal_Funds_Prime_and_LIBOR_Rates_Jan_2021-01-8010722eb0f94ecd9cbabd669c64e4e8.jpg)

The Prime Rate declined to % as the Bank of Canada reduced the policy rate by 25 basis points to %. Inflation reached % in June , down from a. The prime rate is used as a benchmark for banks to determine the interest rates they want to set for various kinds of loans, including credit cards. Economic. Current Prime Rate. Prime Rate Update · % – Effective as of: August 28, · What is Prime Rate? A prime rate or prime lending rate is an interest rate used by banks, usually the interest rate at which banks lend to customers with good credit. rate, and how the prime interest rates affect variable mortgage rates in Canada This tends to slow the entrance of new money into the economy, thereby curbing. Prime Rate History target range for the fed funds rate at % - %. interest rates will be on September 18, New York City Rent Is Too High! The prime rate in Canada as of today is %. The prime rate is a floating rate calculated using the Bank of Canada's overnight target rate, also known as the. For example, the prime rate remained constant at % from March to March but increased seven times throughout the rest of Prime rate history. Prime and Other Rates ; Royal Bank Prime, , /07/25 ; RBC CAD Deposit Reference Rate, , /08/06 ; Royal Bank US Prime · , /07/27 ; Royal. The Prime Rate declined to % as the Bank of Canada reduced the policy rate by 25 basis points to %. Inflation reached % in June , down from a. The prime rate is used as a benchmark for banks to determine the interest rates they want to set for various kinds of loans, including credit cards. Economic. Current Prime Rate. Prime Rate Update · % – Effective as of: August 28, · What is Prime Rate? A prime rate or prime lending rate is an interest rate used by banks, usually the interest rate at which banks lend to customers with good credit. rate, and how the prime interest rates affect variable mortgage rates in Canada This tends to slow the entrance of new money into the economy, thereby curbing. Prime Rate History target range for the fed funds rate at % - %. interest rates will be on September 18, New York City Rent Is Too High! The prime rate in Canada as of today is %. The prime rate is a floating rate calculated using the Bank of Canada's overnight target rate, also known as the. For example, the prime rate remained constant at % from March to March but increased seven times throughout the rest of Prime rate history. Prime and Other Rates ; Royal Bank Prime, , /07/25 ; RBC CAD Deposit Reference Rate, , /08/06 ; Royal Bank US Prime · , /07/27 ; Royal.

Bank Prime Loan Rate Changes: Historical Dates of Changes and Rates (PRIME) ; ; ; ; ; The prime rate helps financial institutions determine how much interest to charge their consumers. · Every six weeks, the Federal Reserve evaluates the economy. Bank Prime Loan Rate is at %, compared to % last month and % last year. This is higher than the long term average of %. The July increase was the 11th increase since the prime rate began climbing on March 17, , one day after the Federal Reserve began increasing another. %. Effective Date. July 25th, TD Prime Rate is the variable annual interest rate published by us from. Over the next few decades, the prime rate fluctuated widely, reflecting the ups and downs of the economy and largely mirroring other benchmark interest rates. The current prime rate among major U.S. banks is %. The prime rate normally runs three percentage points above the central bank's federal funds rate, which. The Bloomberg Prime Rate will change as soon as 13 out of the Top 25 banks, based on Total Assets, change their prime rate. To view a list of Top 25 banks. US Bank Prime Loan Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. Over the next few decades, the prime rate fluctuated widely, reflecting the ups and downs of the economy and largely mirroring other benchmark interest rates. Effective July 25, MCAP Prime Rate is %. When the MCAP Prime Rate changes, you will receive a letter indicating the new prime rate and its effective. As of July 24, , the prime rate is %. How does the prime rate affect me? As a borrower, an increase in the prime rate will. Bank prime loan 2 3 7, , , , , Discount window primary credit 2 8 The rate reported is that for the Federal Reserve Bank of New York. The next interest rate announcement is scheduled for September 4. There are two additional announcements scheduled for October 23 and December Financial institutions and large lenders will base their interest rates on the prime rate, generally establishing their current rates at an amount that is. Graph and download economic data for Bank Prime Loan Rate (DPRIME) from to about prime, loans, interest rate, banks, interest. Bank Lending Rate in the United States remained unchanged at percent in June. This page provides - United States Average Monthly Prime Lending Rate. Prime Rate and Member Rate Index ; %, %, %, % ; %, %, %, %. The U.S. prime rate is in principle the interest rate at which a supermajority (3/4ths) of large banks loan money to their most creditworthy corporate. The prime rate is % as of July , according to the Fed. This is the lowest rate in the past year and since How is the prime rate determined? The.

How Much Money Can I Loan For A House

how much of your home equity you can access. Province or territory. Alberta Borrow more money by refinancing your mortgage with the CIBC Home Power Mortgage. home without the obligation to make regular mortgage payments until you move or sell. How Much Cash Can I Qualify for with a Reverse Mortgage? With a CHIP. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. With a second mortgage, you can use the equity you've built in your home to pay for big-ticket items you may not otherwise have the cash for. How much home. Depending on the type of loan, it can be anywhere from a few hundred dollars to hundreds of thousands of dollars. Your income and employment status play a role. house but are unsure how much income should go to your loan payment lender analyze the risk associated with lending you the money to buy a house. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. As a rule of thumb, lenders tend to offer up to x your annual salary. If you're buying with someone, they will combine your salaries to reach a figure they. In other words, if your monthly gross income is $10, or $, annually, your mortgage payment should be $2, or less. $10, X 28% = $2, – maximum. how much of your home equity you can access. Province or territory. Alberta Borrow more money by refinancing your mortgage with the CIBC Home Power Mortgage. home without the obligation to make regular mortgage payments until you move or sell. How Much Cash Can I Qualify for with a Reverse Mortgage? With a CHIP. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. With a second mortgage, you can use the equity you've built in your home to pay for big-ticket items you may not otherwise have the cash for. How much home. Depending on the type of loan, it can be anywhere from a few hundred dollars to hundreds of thousands of dollars. Your income and employment status play a role. house but are unsure how much income should go to your loan payment lender analyze the risk associated with lending you the money to buy a house. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. As a rule of thumb, lenders tend to offer up to x your annual salary. If you're buying with someone, they will combine your salaries to reach a figure they. In other words, if your monthly gross income is $10, or $, annually, your mortgage payment should be $2, or less. $10, X 28% = $2, – maximum.

The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should spend no more than 28% of your pre-tax income on your. The 28/36 Rule is a commonly accepted guideline used in the U.S. and Canada to determine each household's risk for conventional loans. It states that a. As a rule of thumb, lenders tend to offer up to x your annual salary. If you're buying with someone, they will combine your salaries to reach a figure they. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. pay in cash to buy the property outright. An overseas mortgage is any mortgage you take out on a property that's not in your country of residence. It can. A TD Personal Loan can help you get the money for renovating your home, clearing up higher interest debt or making a big purchase. You can borrow up to $50, How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. You can reverse the calculation and multiply your income by to determine a target mortgage payment. 36% is the limit to your total debt, including the. The following housing ratios are used for conservative results: 29% for down payments of less than 20% and 30% for down payments of 20% or more. A debt ratio of. This calculator helps you determine whether or not you can qualify for a home mortgage based on income and expenses. Please specify how much you would like to. Many lenders have a maximum CLTV ratio of 80%. If your home is worth $, and you have no existing mortgage, the maximum you could borrow would be 80% or. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income (DTI) ratio. It is recommended that your DTI. The question isn't how much you could borrow but how much you should borrow. These home affordability calculator results are based on your debt-to-income ratio. Obligations like loan and debt payments or alimony, but not costs like groceries or utilities. Down Payment. Cash. Cash you can pay when you close. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. You must use the loan for a down payment (you can't use the loan for financing, closing or other costs). Help with your application. The Down Payment. It could be more than $5, in monthly costs. Moreover, lenders will consider your debt-to-income ratio, which should ideally be below 36%. This ratio. Many people will tell you that the rule of thumb is you can afford a mortgage that is two to two-and-a-half times your gross (aka before taxes) annual salary.

Triple Aaa Insurance Customer Service Number

Agency Locations | Service | Contact Us | Insurance Customer Portal. Financial Services. From savings to lending our experienced team is here to help you. Call () to speak with an experienced AAA Insurance agent. Llame para hablar en español () To speak with a AAA Insurance Advisor, call () or find a branch to meet in-person. Find a Branch. AAA Temecula Insurance and Member Services - What happened to AAA Customer Service? Triple AAA - Automobile Club of Southern California Roadside. With auto insurance through AAA, you have the added benefit of AAA Accident Assist. Which means if you're in a crash, your vehicle is no longer drivable and you. We serve Washington and northern Idaho; if you live elsewhere, find your local AAA club here. You can also call us at () Contact Us. Membership. Join/Renew AAA; Duplicate/replace card; Billing information; Add associate or upgrade; Refunds. Call us. () Hours. Insurance Services ; AAA Northway Insurance Agency Sales, Mon – Fri, 9 a.m. – 5 p.m. ; AAA Northway Insurance Agency Customer Service, Please request roadside assistance online or call Send us an email for: eumusic.ru support; Membership, insurance, or travel questions; Mobile. Agency Locations | Service | Contact Us | Insurance Customer Portal. Financial Services. From savings to lending our experienced team is here to help you. Call () to speak with an experienced AAA Insurance agent. Llame para hablar en español () To speak with a AAA Insurance Advisor, call () or find a branch to meet in-person. Find a Branch. AAA Temecula Insurance and Member Services - What happened to AAA Customer Service? Triple AAA - Automobile Club of Southern California Roadside. With auto insurance through AAA, you have the added benefit of AAA Accident Assist. Which means if you're in a crash, your vehicle is no longer drivable and you. We serve Washington and northern Idaho; if you live elsewhere, find your local AAA club here. You can also call us at () Contact Us. Membership. Join/Renew AAA; Duplicate/replace card; Billing information; Add associate or upgrade; Refunds. Call us. () Hours. Insurance Services ; AAA Northway Insurance Agency Sales, Mon – Fri, 9 a.m. – 5 p.m. ; AAA Northway Insurance Agency Customer Service, Please request roadside assistance online or call Send us an email for: eumusic.ru support; Membership, insurance, or travel questions; Mobile.

Claims Reporting ; Member Select (AAA), press 1, N/A ; Monarch, x, N/A ; Nationwide, , N/A ; NFIP, press 1. If you need help with American Automobile Association (AAA), you can contact our advocacy team or just click the "Get Help" button. For immediate assistance. Customer Contact. Mr. John Onorato, Owner; Mr. Jared Peterson, Vice President number of complaints. BBB Business Profiles generally cover a three. You can also order documents over the phone by calling or by visiting your local AAA office. To find an insurance professional at AAA near you. Call () to speak with an experienced AAA Insurance agent. Roadside Assistance. 24 Hours a Day/ 7 Days a Week. () ; Membership Services. 24hrs a Day/ 7 Days a Week. () ; Travel Services. Mon - Fri. AAA Northeast Insurance Agency's customer service phone number is Mon – Thu: 8am – 7pm, Fri: 8am – 6pm, Sat: 9am – 4pm. Claims Mail Address - Auto/Glass only - all other call · Claims Phone: · Manage & Pay Phone: To speak with a AAA Insurance Advisor, call () or find a branch to meet in-person. Find a Branch. Only GEICO auto insurance policyholders are eligible for Emergency Road Service. Still have questions about the roadside assistance services provided by GEICO? Contact AAA at and for insurance and membership issues, respectively. Members can also call AAA customer service to inquire. Insurance Sales: () Insurance Customer Service:() Discounts. Entertainment. Tickets & Activities · Dining Discounts · Movie Discounts. Insurance Services · Bicycle Coverage. Other Benefits. ProtectMyID Insurance Customer Portal. Medicare. Medicare Overview · Medicare · Working. Insurance Customer Service:() Discounts. Entertainment. Tickets number in their name. Must provide Proof of Incorporation (see ID and. Please have your membership number handy and include it in all correspondence; this helps us assist you more efficiently. What can we help you with? AAA. Insurance Sales. Mon - Fri: 8am - 8pm, Sat: 9am - 2pm. () ; Insurance Customer Service. Mon - Fri: 8am - pm. () ; Insurance Medicare. AAA Mobile improves on-the-go access to trusted AAA services including trip planning, discounts and roadside assistance I'm a first time user of the AAA app. Motor Club Insurance Company (MCIC) ; Pay Your Bill with MCIC. Payments are quick, easy, and secure with MCIC. MAKE A PAYMENT ; File a Claim. Report a claim. Call AAA-HELP (); Request service online · Use the AAA Mobile app. *Certain restrictions apply. Valid Membership card required. **Certain. AAA provides services to its members, including roadside assistance and others. Its national headquarters are in Heathrow, Florida. American Automobile.

How Much Can I Get For First Time Home Buyer

Does my potential home qualify? · New and existing single family homes. · Owner-occupied, 2- to 4-unit apartment buildings. · Condominiums. · Permanently attached. The 97% loan-to-value mortgage requires 3% down, as the name may suggest. Borrowers can get down payment and closing cost assistance from third-party sources. The down payment can vary, depending on the loan product, from 3% to 20% or more. Putting less than 20% down will typically require you to pay for private. Determine How Much Home You Can Afford. Determining how much you can afford is an important first step in shopping. This can help you get a better. Households can receive up to 10% of the purchase price and cannot exceed an amount of 40, There is a list of homebuyer requirements and property. No down payment required · Low mortgage rates · % financing · Reduced monthly mortgage insurance · Closing costs can come from a gift · Easy to qualify for. Find first-time homebuyer loans and programs that can help you confidently enter the housing market. Learn home buying tips and information with Wells. Our NC Home Advantage Mortgage™ offers down payment assistance up to 3% of the loan amount that can help first-time and move-up buyers get into a new home. Figure out how much you can afford. What Let FHA help you (FHA loan programs offer lower downpayments and are a good option for first-time homebuyers!). Does my potential home qualify? · New and existing single family homes. · Owner-occupied, 2- to 4-unit apartment buildings. · Condominiums. · Permanently attached. The 97% loan-to-value mortgage requires 3% down, as the name may suggest. Borrowers can get down payment and closing cost assistance from third-party sources. The down payment can vary, depending on the loan product, from 3% to 20% or more. Putting less than 20% down will typically require you to pay for private. Determine How Much Home You Can Afford. Determining how much you can afford is an important first step in shopping. This can help you get a better. Households can receive up to 10% of the purchase price and cannot exceed an amount of 40, There is a list of homebuyer requirements and property. No down payment required · Low mortgage rates · % financing · Reduced monthly mortgage insurance · Closing costs can come from a gift · Easy to qualify for. Find first-time homebuyer loans and programs that can help you confidently enter the housing market. Learn home buying tips and information with Wells. Our NC Home Advantage Mortgage™ offers down payment assistance up to 3% of the loan amount that can help first-time and move-up buyers get into a new home. Figure out how much you can afford. What Let FHA help you (FHA loan programs offer lower downpayments and are a good option for first-time homebuyers!).

Federal Housing Administration (FHA) Mortgages – requires only % down, and all of the funds can be a gift from a relative. Ohio Housing Financing Association. Don't make the mistake of buying a house you cannot afford. A general rule of thumb is to use the 28/36 rule. This rule says your mortgage should not cost you. Generally, most conventional loans require a down payment of at least 3%–5% of the purchase price, while FHA loans have a minimum down payment of %. However. Terms: Applicants can receive up to $8, for a down payment, closing costs, principal mortgage reduction, and interest buy down in the form of a second. First-time homebuyers often qualify for special benefits, such as lower minimum down payments, special grants, and assistance with paying closing costs. Considering that the purchase of a home is the biggest investment most people will ever make, the idea of buying a house can be daunting. However, if you're. Many are unaware that a first-time homebuyer can actually have owned a home find out how much they can borrow and what their monthly payments will be. How much assistance can I get? It varies by program (see the list above) homebuyer, using the Covenant, Home Advantage or House Key first mortgage programs. The Mortgage Credit Certificate program allows the first-time homebuyer to claim 10%% of their mortgage interest up to $2, for as long as they live in the. No down payment required · Low mortgage rates · % financing · Reduced monthly mortgage insurance · Closing costs can come from a gift · Easy to qualify for. Follow the 8 Steps below to make the home-buying process a little easier! CHFA can help with financing. We offer year, fixed-rate mortgages with below-. This means you need a minimum of % for a down payment. You can use our Great Choice Plus down payment assistance for any loan-related costs, including your. Learn about government programs that make it easier to buy a home, including loans, mortgage assistance, and vouchers for first-time home buyers. The FHA mortgage will require % down payment. Get a Preapproved Mortgage. Get a mortgage preapproval before you start looking to ensure you are not wasting. These payment assistance programs have helped make the dream of home ownership come true for many first-time buyers–and you could be next. trophy icon. VA Home. “TSAHC's programs make homeownership possible for many Texas families. I am proud to be a participating loan officer in TSAHC's programs so I can help families. Homebuyers must make an investment of 1% but no more than 10% of the sale price from their own funds. This program can be paired with other homebuyer programs. Learn about government programs that make it easier to buy a home, including loans, mortgage assistance, and vouchers for first-time home buyers. First-Time Homebuyers · Income limits up to $, based on county. · House price purchase limits up to $, in the county Metro area and $, for. Homebuyers must make an investment of 1% but no more than 10% of the sale price from their own funds. This program can be paired with other homebuyer programs.

1 2 3 4 5