eumusic.ru

Prices

What Makes A Great Onboarding Experience

What makes for a good employee onboarding experience? · Shows how you embody your company's values · Builds trust between coworkers and leaders · Explores new. In another study conducted by Bamboo HR, employees who have an effective onboarding experience were found to be 18 times more likely to feel. 7 onboarding best practices for new employees · 1. Engage new hires with preboarding first · 2. Introduce and demonstrate company values as early as possible · 3. 7. Create an epic welcome & workspace orientation experience Think about what makes your team or the role unique and find a way for your teams onboarding to. The best onboarding experience is to work and mix with the people at the coal face and delivery end. For weeks. The best way to learn management. In fact, 69% of employees are more likely to stay with a company for three years if they experienced a great onboarding process, according to SHRM. This is. 8 ways to build the best employee onboarding experience · 1. Document of compliance · 2. Asset management · 3. Contact information · 4. Mentorship · 5. Informal tour. The best onboarding experience is to work and mix with the people at the coal face and delivery end. For weeks. The best way to learn management. The 4Cs of the best employee onboarding experience · 1. Compliance · 2. Clarification · 3. Culture · 4. Connection. What makes for a good employee onboarding experience? · Shows how you embody your company's values · Builds trust between coworkers and leaders · Explores new. In another study conducted by Bamboo HR, employees who have an effective onboarding experience were found to be 18 times more likely to feel. 7 onboarding best practices for new employees · 1. Engage new hires with preboarding first · 2. Introduce and demonstrate company values as early as possible · 3. 7. Create an epic welcome & workspace orientation experience Think about what makes your team or the role unique and find a way for your teams onboarding to. The best onboarding experience is to work and mix with the people at the coal face and delivery end. For weeks. The best way to learn management. In fact, 69% of employees are more likely to stay with a company for three years if they experienced a great onboarding process, according to SHRM. This is. 8 ways to build the best employee onboarding experience · 1. Document of compliance · 2. Asset management · 3. Contact information · 4. Mentorship · 5. Informal tour. The best onboarding experience is to work and mix with the people at the coal face and delivery end. For weeks. The best way to learn management. The 4Cs of the best employee onboarding experience · 1. Compliance · 2. Clarification · 3. Culture · 4. Connection.

Help improve employee retention — thanks to making a great first impression · Set the foundations for a positive employee experience — with the help of. Mega-brands are at the top for a reason. They treat their internal customers like external customers. They also know what makes a great onboarding experience. 1. Welcome Message · 2. Make a List of Everything an Employee Needs to be Successful in Their Role · 3. Establish a Framework for the Onboarding Curriculum · 4. Make sure their desk is organized and clean · Tape a welcome sign to their cube/office/desk area · Ensure they have a name plate and appropriate. Set out clear, achievable goals, and use regular managerial check-ins to communicate progress and recognize the new hire for a job well done. It's also a good. A good onboarding experience shows employees that their workplace will be supportive, as well as one that encourages professional development. Within the first. Tips for creating the best onboarding experience include setting clear expectations, establishing balanced programs, creating memorable experiences, and. 1. Let new hires know inclusion matters · 2. Paint the big picture · 3. Prepare your team · 4. Help them speak your language · 5. Contextualize their experience · 6. What makes a good user onboarding experience? A positive onboarding experience should take the individual needs of each new signup into account. A positive onboarding experience is crucial to an employees overall experience within your organisation as it lays out the expectations and the work. Creating an effective onboarding program will highlight the achievements and talents of your HR department and increase employee satisfaction. Through a better. 7 Creative Ideas To Make Your Employee Onboarding Amazing · 1. Give Your New Employees Mad Swag. · 2. Give new hires a chance to unwind before starting · 3. Make. The onboarding experience is vital because it demonstrates that the company is dedicated to them, which, in turn, creates engaged employees with a strong. 1. Netflix – a culture and leadership-driven onboarding program · 2. Quora – tailoring new hire goals to their booming start-up · 3. Digital Ocean's – a people-. Culture encompasses the company's values, norms, and practices. It's what makes a company unique. Google, for instance, immerses new hires in its culture. Onboarding Best Practices · Start communicating before your new hire's first day · Set up the employee's workspace before they arrive · Send out a new employee. Giving people clear things to strive for – and providing regular, productive feedback – makes new employees feel valued and motivated. It makes them feel as. Building a strong onboarding process is the best way to welcome, and retain, new employees. Effective onboarding is all about planning ahead and thinking from. Help improve employee retention — thanks to making a great first impression · Set the foundations for a positive employee experience — with the help of. However qualified and experienced a new hire might be, employees who are more seasoned and familiar with company processes are invaluable resources to answer.

Buy Crypto Using Amex

Next, select "Buy Bitcoin" and choose "American Express Card" as the payment method. This will display all available offers accepting Amex cards. It's. How to buy BTC with a credit or debit card · Tap Transact on your portfolio screen · Tap 'From' and select 'Credit or Debit cards' · Tap + and enter your card. Buy Bitcoin, Ethereum with American Express. Buy BTC, ETH, USDC, USDT, DAI and more cryptos worldwide using + payment methods. Amex cards do not really support this functionality. However, there are other ways through which you can buy, sell, or trade Bitcoin and other. Buy crypto & Bitcoin instantly with a credit card on Australia's easiest crypto exchange. Use your VISA or MasterCard to buy Bitcoin & other popular crypto! You can buy coins in many ways, including with a credit card. Make sure you have your credit card number, card verification value, and expiry date. Buying crypto with an Amex credit card may involve specific fees or charges. It's essential to review the terms and conditions associated with your credit and. You can buy them on a digital exchange platform- whether it's a regular gift card vendor or a P2P platform. Let's dive right into how you can buy Bitcoin with. If you want to buy Bitcoin with American Express, you will need to sign up for a platform that will accept American Express credit cards and make a purchase. We. Next, select "Buy Bitcoin" and choose "American Express Card" as the payment method. This will display all available offers accepting Amex cards. It's. How to buy BTC with a credit or debit card · Tap Transact on your portfolio screen · Tap 'From' and select 'Credit or Debit cards' · Tap + and enter your card. Buy Bitcoin, Ethereum with American Express. Buy BTC, ETH, USDC, USDT, DAI and more cryptos worldwide using + payment methods. Amex cards do not really support this functionality. However, there are other ways through which you can buy, sell, or trade Bitcoin and other. Buy crypto & Bitcoin instantly with a credit card on Australia's easiest crypto exchange. Use your VISA or MasterCard to buy Bitcoin & other popular crypto! You can buy coins in many ways, including with a credit card. Make sure you have your credit card number, card verification value, and expiry date. Buying crypto with an Amex credit card may involve specific fees or charges. It's essential to review the terms and conditions associated with your credit and. You can buy them on a digital exchange platform- whether it's a regular gift card vendor or a P2P platform. Let's dive right into how you can buy Bitcoin with. If you want to buy Bitcoin with American Express, you will need to sign up for a platform that will accept American Express credit cards and make a purchase. We.

Receive 10% off concessions purchases when you use an American Express® Card, excluding American Express Prepaid Cards, to pay for your purchase at any. Sell American Express Gift Cards for Bitcoin & other crypto instantly on CoinCola. Buy Bitcoin with American Express Gift Cards or sell them for crypto. You can now buy cryptocurrencies instantly with credit card, debit card or with bank transfer. Get started. Start with as little as $ Buy Bitcoin Online with a Debit Card or Credit Card ($50 min; $10k initial order limit; $20k daily limit). Click the “Buy” icon. · Enter the amount and select the crypto you want to buy. · Select credit/debit card as your payment method. · Input your card details. Note: Coinbase no longer supports linking new credit cards and some card issuers are blocking digital currency purchases with existing credit cards. If you have. $60, CoinJar is a platform for buying, selling, and managing Bitcoin and other cryptocurrencies. It caters to both everyday users and professional. I was given an American Express gift card for my birthday and want to use it to buy crypto but have no idea where or how Hey! We accept Visa, Mastercard, American Express, JCB, Discover, and Diners Club credit cards or debit cards. We also accept cryptocurrencies via eumusic.ru Pay. Buy Bitcoin instantly. Pay securely with a debit card, credit card or prepaid card. No hidden fees. Competitive Rates. 2-minutes fast exchange. BitPay is a crypto marketplace that allows you to buy Bitcoin with American Express through Sardine or from other providers through a variety of payment methods. In this guide, we'll walk through everything you need to know about buying cryptocurrency with a credit card — including the best cards and the best exchanges. In short, yes you can buy crypto with a credit card. Some of the most popular cryptocurrency exchanges allow you to make purchases with credit cards. Yes.. To buy Bitcoin with an American Express card, find a third-party cryptocurrency exchange such as Paxful or LocalBitcoins that accepts. Cryptocurrency investors may purchase Bitcoin with a credit card. Consider the type of credit card and the exchange you use before you link your card. Be aware. Buy Bitcoin with American Express Gift Card using BitValve P2P Crypto exchange instantly and securely! Use American Express Gift Card to buy BTC from. In essence, Google Pay allows users to buy Bitcoin with a credit card and buy Bitcoin with a bank account if they choose to securely store that information on. Compare rates and buy cryptocurrency instantly with debit card, credit card, bank transfer, or local methods from anywhere. Invest in Bitcoin with Invity. MoonPay users can easily buy cryptocurrencies with credit card, bank transfers, Apple Pay, or Google Pay. Buying Bitcoin (BTC) with a credit or debit card is possible in Ledger Live through our partner Coinify. Your newly bought crypto is immediately sent to the.

Backdoor Roth Rollover

Three different tax documents will be produced as a result of the Roth IRA conversion “transaction.” Two of the documents will be associated with the. Why you might convert a traditional IRA to a Roth IRA · Enjoy tax-free withdrawals in retirement · Watch your money grow tax-free for longer · Leave a tax-free. The backdoor Roth IRA is a strategy used by high earners for converting a traditional IRA to a Roth IRA. · Using this strategy, you can contribute to an IRA and. The strategy used by high-income earners to make Roth IRA contributions involves the deposit of non-deductible contributions to a Traditional IRA and then. In Congress changed the rules governing the conversion of a Traditional IRA to a Roth IRA. This change eliminated the income restrictions and allowed all. For instance, if you expect your income level to be lower in a particular year but increase again in later years, you can initiate a Roth conversion to. A mega backdoor Roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a Roth account, based on their income. Backdoor Roth IRA contribution limit. The IRA contribution limit for is $6, per person, or $7, if the account owner is 50 or older. In , the. A backdoor Roth IRA allows you to get around income limits by converting a traditional IRA into a Roth IRA. You'll get a Form R the year you make the. Three different tax documents will be produced as a result of the Roth IRA conversion “transaction.” Two of the documents will be associated with the. Why you might convert a traditional IRA to a Roth IRA · Enjoy tax-free withdrawals in retirement · Watch your money grow tax-free for longer · Leave a tax-free. The backdoor Roth IRA is a strategy used by high earners for converting a traditional IRA to a Roth IRA. · Using this strategy, you can contribute to an IRA and. The strategy used by high-income earners to make Roth IRA contributions involves the deposit of non-deductible contributions to a Traditional IRA and then. In Congress changed the rules governing the conversion of a Traditional IRA to a Roth IRA. This change eliminated the income restrictions and allowed all. For instance, if you expect your income level to be lower in a particular year but increase again in later years, you can initiate a Roth conversion to. A mega backdoor Roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a Roth account, based on their income. Backdoor Roth IRA contribution limit. The IRA contribution limit for is $6, per person, or $7, if the account owner is 50 or older. In , the. A backdoor Roth IRA allows you to get around income limits by converting a traditional IRA into a Roth IRA. You'll get a Form R the year you make the.

A Roth conversion is a way to bypass the income limits on Roth contributions by high wage earners. There is no limit to how much you can convert to a Roth IRA. What is a backdoor Roth IRA conversion? The so-called backdoor Roth is one way one can avoid a big tax bill when you earn more than the income limit for a Roth. You generally do not want to use your actual IRA funds to pay the taxes due during a backdoor Roth IRA conversion. This can slow down the growth of your. Otherwise, you'll owe income tax on the investment gains from the nondeductible funds when you convert to the Roth. That's why Pfau recommends making your. A mega-backdoor Roth is a special type of (k) rollover strategy used by people with high incomes to deposit funds into a Roth IRA or Roth (k). To build a. The federal tax on a Roth IRA conversion will be collected by the IRS, with the rest of your income taxes due on the return you file for the. Rollovers to multiple destinations · A direct rollover of $80, in pretax amounts to a traditional (non-Roth) IRA or a pretax account in another plan, · A. Among the proposed reforms is ending “backdoor” Roth individual retirement account (IRA) conversions. Backdoor Roth IRA conversion is a method for higher-. A "backdoor Roth IRA" is a potential way for those who don't qualify for Roth IRA contributions to still be able to convert to a Roth and enjoy the tax-free. If you're rolling a traditional (k) into a traditional IRA, you will be increasing your total base of pre-tax assets subject to the pro-rata rule. A Roth A backdoor Roth can be created by first contributing to a traditional IRA and then immediately converting it to a Roth IRA to avoid paying taxes on any earnings. If the individual does not currently have an IRA, the non-deductible (after-tax) contribution will make up % of her IRA balance. When the conversion is made. When you do a backdoor Roth conversion from a traditional IRA to a Roth IRA, you don't get to choose which funds are converted. So if you have. If the balances in your IRA or IRAs are small and you can afford the taxes on the conversion, you can convert it all to Roth and just pay tax on the conversion. What is a backdoor Roth IRA conversion? The so-called backdoor Roth is one way one can avoid a big tax bill when you earn more than the income limit for a Roth. If you already have tax-deductible pre-tax contributions in your Traditional IRA and try to do a Backdoor Roth conversion, you might get hit with a tax bill due. Distributions of Roth IRA earnings are tax-free, as long as the Roth IRA has been open for more than five years and you are at least age 59 1/2, or as a result. Backdoor Roth IRA Examples If you have no other Traditional, SEP, or SIMPLE IRAs and just made a nondeductible contribution of $7, to your new Traditional. To enter data for a traditional IRA converted to a Roth IRA (also known as a backdoor Roth), complete the following steps. Conversion to Roth. field. Conversion rules and limitations There are limits to how much you can contribute when utilizing the backdoor Roth IRA strategy. As with traditional and Roth.

Do I Have To Pay Tax On A Gift

The gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or the use of or income from. If you eventually exhaust your lifetime exclusion and must pay gift taxes, the rate you'll pay depends on the value of gifts subject to taxes. The gift tax rate. The gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or the use of or income from. Essentially, gifts are neither taxable nor deductible on your tax return. Also, a monetary gift has to be substantial for IRS purposes — In order for the giver. The gift tax is the tax levied on the transfer of money or property to another person, with no compensation or with compensation that is not equivalent to the. For taxable income, courts have defined a "gift" as the proceeds from a "detached and disinterested generosity." Gifts are often given out of "affection. The gift tax rates in range from 18% to 40%, depending on the amount by which your gifts exceed the exemptions. (In , it was $ million.) This shields most people from having to pay federal gift tax. You report excess amounts beyond the annual exclusion on Form. For gifts from a US person, the US recipient is not taxed and does not have any reporting requirement. Upvote. The gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or the use of or income from. If you eventually exhaust your lifetime exclusion and must pay gift taxes, the rate you'll pay depends on the value of gifts subject to taxes. The gift tax rate. The gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or the use of or income from. Essentially, gifts are neither taxable nor deductible on your tax return. Also, a monetary gift has to be substantial for IRS purposes — In order for the giver. The gift tax is the tax levied on the transfer of money or property to another person, with no compensation or with compensation that is not equivalent to the. For taxable income, courts have defined a "gift" as the proceeds from a "detached and disinterested generosity." Gifts are often given out of "affection. The gift tax rates in range from 18% to 40%, depending on the amount by which your gifts exceed the exemptions. (In , it was $ million.) This shields most people from having to pay federal gift tax. You report excess amounts beyond the annual exclusion on Form. For gifts from a US person, the US recipient is not taxed and does not have any reporting requirement. Upvote.

Who does not pay Inheritance Tax. Some gifts are exempt from Inheritance Tax. There's no Inheritance Tax to pay on gifts between spouses or civil partners. You. Spouses are not allowed to file a joint gift tax return, they much each fill out their own forms if they have made a gift of over $15, Married couples can. Do you pay taxes when you receive a gift? As discussed above, the gift receiver is not responsible for gift tax when they receive a gift. The gift receiver also. You do not pay tax on a cash gift, but you may have to pay tax on any income that the cash gift generates. Cash gifts can be subject to tax rates that range from 18% to 40%, depending on the size of the gift. The person making the gift is responsible for reporting. Taxes do not apply to gift cards and gift certificates at the time of sale. Businesses who issue gift cards and gift certificates should report income when the. A gift tax is a tax on the transfer of property by a living individual, without payment or a valuable exchange in return. At the federal level, assets you receive as a gift are usually not taxable income. However, if the assets generate income in the future (for example, interest. If a gift is made by a nonresident not a citizen of the United States who was not an expatriate, the gift tax applies only to the transfer of real property and. Does the gift tax apply only to cash gifts? No. Other assets can also count, including gifts of real estate, stock shares, a car or fine art and collectibles. The good news is that these gifts do not have to be included in the taxable income of the receiving family member(s). Many Canadian parents have done this. Spouses splitting gifts must always file Form , even when no taxable gift is incurred. Once you give more than the annual gift tax exclusion, you begin to. Because of the lifetime gift tax exemption, most Americans will never have to pay the gift tax. But high-net-worth individuals who will have more than the. Next, think of the income and capital gains tax consequences for the beneficiary of the gift. Not all gifts are treated equally. If you gift cash, generally. (In , it was $ million.) This shields most people from having to pay federal gift tax. You report excess amounts beyond the annual exclusion on Form. It would have to be a large gift, before tax is imposed. Congress and our current tax laws have said that if you make a transfer less than $ million, you. However, the United States has no foreign gift tax1, and the gift does not count as taxable income, so no taxes are typically due. (However, if the asset gifted. The reason for that is because your birthday gifts likely don't exceed the gift tax limit. And if you're lucky enough that they do, there are still several. Because of the lifetime gift tax exemption, most Americans will never have to pay the gift tax. But high-net-worth individuals who will have more than the. But the giver (“donor”) needs to be aware that giving a gift may trigger tax-reporting requirements. In certain situations, the IRS requires a donor to report a.

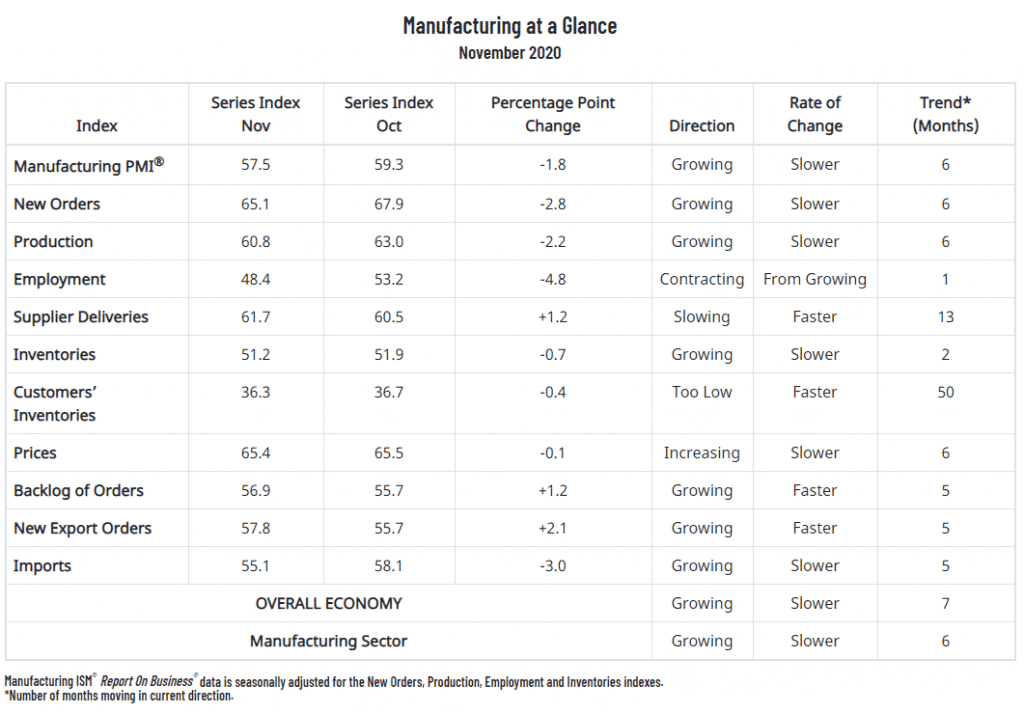

Ism Index

The ISM Manufacturing Index marginally improved in August, rising to and just short of expectations of a print. As in July, only five industries. Index performance for ISM Manufacturing PMI SA (NAPMPMI) including value, chart, profile & other market data. US ISM Manufacturing PMI is at a current level of , up from last month and down from one year ago. This is a change of % from last. The ISM Manufacturing PMI is the equally weighted summation of diffusion indexes of five of the above indicators: new orders, production, employment, supplier. ISM, SIPMM, and Markit purchasing managers indices include additional sub indices for manufacturing surveys such as new orders, employment, exports, stocks of. The ISM manufacturing index measures the condition of the US economy based on a monthly poll of purchasing managers in over manufacturing companies. US ISM Manufacturing New Orders Index is at a current level of , down from last month and down from one year ago. Looking for a supply chain association to advance your career? For over a century, ISM has been the representative body for supply chain and procurement. The Manufacturing ISM Report On Business is based on data compiled from purchasing and supply executives nationwide. Survey responses reflect the change. The ISM Manufacturing Index marginally improved in August, rising to and just short of expectations of a print. As in July, only five industries. Index performance for ISM Manufacturing PMI SA (NAPMPMI) including value, chart, profile & other market data. US ISM Manufacturing PMI is at a current level of , up from last month and down from one year ago. This is a change of % from last. The ISM Manufacturing PMI is the equally weighted summation of diffusion indexes of five of the above indicators: new orders, production, employment, supplier. ISM, SIPMM, and Markit purchasing managers indices include additional sub indices for manufacturing surveys such as new orders, employment, exports, stocks of. The ISM manufacturing index measures the condition of the US economy based on a monthly poll of purchasing managers in over manufacturing companies. US ISM Manufacturing New Orders Index is at a current level of , down from last month and down from one year ago. Looking for a supply chain association to advance your career? For over a century, ISM has been the representative body for supply chain and procurement. The Manufacturing ISM Report On Business is based on data compiled from purchasing and supply executives nationwide. Survey responses reflect the change.

Description. The ISM Report on Business® is composed of data from over purchasing executives in the manufacturing sector, representing 20 industries. The Services Index is a composite index of four indicators with equal weights: Business Activity, New Orders, Employment and Supplier Deliveries. The Institute for Supply Management's (ISM) manufacturing index increased for the second consecutive month, rising points from September to a reading of Actual, previous and consensus values with detailed economic analysis for United States ISM Manufacturing Index. The ISM manufacturing index, also known as the purchasing managers' index (PMI), is a monthly indicator of economic activity based on a survey. ISM services index rebounds, but still consistent with lower inflation The rise in the ISM services index to in May, from , meant that the weighted. What is the ISM New Order Index? ISM New Order Index shows the number of new orders from customers of manufacturing firms reported by survey respondents. The ISM Manufacturing New Orders index in the United States decreased to points in August , the lowest reading since May , compared to points. ISM Index. The American early indicator is based on a monthly survey among purchasing managers from companies in 20 representative US industry sectors. The ISM Manufacturing Index is a monthly gauge on the level of economic activity in the U.S. manufacturing sector versus the previous month. The ISM Manufacturing PMI edged higher to in August of from the November low of in the previous month, missing market expectations of. The NMI is a composite index based on the diffusion indexes for four of the indicators with equal weights: Business Activity (seasonally adjusted), New Orders . Free economic data, indicators & statistics. ISM Manufacturing Index from ISM. The ISM Non-Manufacturing Index (now called the Services PMI) is an index used to assess the performance of services companies in the United States. Description. The ISM Report on Business® is composed of data from over purchasing executives in the manufacturing sector, representing 20 industries. The Institute of Supply Management (ISM) has released its August services purchasing managers' index (PMI). The headline composite index is at Index State Management (ISM) is a plugin that lets you automate these periodic, administrative operations by triggering them based on changes in the index age. Index State Management (ISM) in Amazon OpenSearch Service lets you define custom management policies that automate routine tasks, and apply them to indexes. ISM Index ; CNBC Daily Open: Higher manufacturing prices gave markets a bad start to March · Daily Open ; December ISM Non-Manufacturing PMI Index moves under The Institute for Supply Management (ISM) surveys purchasing managers in the service sector every month to produce the ISM Services Purchasing Managers'.

Cost Of Hosting A Website

The web hosting costs highlighted above come to $ But if you add-on all of the package extras to your plan, your total becomes $ That's a big jump. Affordable Shared Hosting services from Namecheap. Fast and cheap hosting with % uptime guarantee and 24/7 Live Chat support. Starts from $/mo! Average cost: The cost for this type of hosting usually starts around $80 per month. Blazing Fast, Low Cost Shared Web Hosting. Set up a professional website with our flexible and reliable shared hosting plans. Uncover your potential with A2. It is affordable because you share a server with various companies who also want a low-cost web hosting plan. Here's a few articles about hosting your website. Web hosting prices are based on server space and bandwidth. Thus, smaller websites will require less hosting than larger sites, and at a lower cost. Important. Hosting costs for a website typically range from $3 to $10 per month for basic shared hosting, while more advanced options like VPS or dedicated. For businesses, website hosting costs $24 to $10, per year. That's a massive price range, which is why it's helpful to separate hosting costs into these. Web hosting services should cost between $2 and $90 per month for most hosting options. The answer depends on what type of hosting best suits your online needs. The web hosting costs highlighted above come to $ But if you add-on all of the package extras to your plan, your total becomes $ That's a big jump. Affordable Shared Hosting services from Namecheap. Fast and cheap hosting with % uptime guarantee and 24/7 Live Chat support. Starts from $/mo! Average cost: The cost for this type of hosting usually starts around $80 per month. Blazing Fast, Low Cost Shared Web Hosting. Set up a professional website with our flexible and reliable shared hosting plans. Uncover your potential with A2. It is affordable because you share a server with various companies who also want a low-cost web hosting plan. Here's a few articles about hosting your website. Web hosting prices are based on server space and bandwidth. Thus, smaller websites will require less hosting than larger sites, and at a lower cost. Important. Hosting costs for a website typically range from $3 to $10 per month for basic shared hosting, while more advanced options like VPS or dedicated. For businesses, website hosting costs $24 to $10, per year. That's a massive price range, which is why it's helpful to separate hosting costs into these. Web hosting services should cost between $2 and $90 per month for most hosting options. The answer depends on what type of hosting best suits your online needs.

$/mo. · We're the largest hosting provider around. · Our websites load faster and deliver performance and security. · Simple and easy interfaces. · Done right. With HubSpot, website hosting is free with no added usage fees and no need to go through a third-party hosting provider. What's the difference between web. Choose your Web Hosting Plan ; SAVE 14%. Personal. Build a single website. $6 ; SAVE 27%. Premium. Multiple sites, unlimited email. $8 ; SAVE 28%. Business. Built. Choose the perfect hosting package ; Basic. All the hosting you need to get online. First Year Offer*. $ · Renews at $/mo · 1 Website ; MOST POPULAR. Plus. You can find a few better deals out there, but you can generally expect to pay $20 to $50 per month. Dedicated server hosting is definitely the most expensive. Let us host you ; Starter web hosting. For getting started online · $ ; Personal web hosting. For creating your website or blog. $ ; Professional web. Choose your web hosting plan ; Essential. Everything you need to host your first website. Save 33%$6/month · 4 ; Starter. More capacity, ideal for growing websites. The total cost of hosting your personal website on AWS will vary depending on your usage. Typically, it will cost $/month if you are outside the AWS Free. Gator Website Builder Hosting ; Express Start · $ · 1 Year, $, $ 2 Years, $, $ ; Express Site · $ · 1 Year, $, $ 2 Years. If you have a website that generates income, ie does something, then building it in the first place will tend to be treated as a Fixed (non-current) Asset and. We look at pricing here based on companies' regular annual prices, with no discounts applied. Our cutoff for inclusion? A web host must charge no more than. The AWS Hosting cost could be around $20 – $30 USD per moth. For those “Web Agencies” that host several WordPress sites within a server/VPS. If you decide to build a site from scratch, you'll need to pay for hosting separately, the costs of which can range from $ to $ per month, depending on. Building Your Website: 3 Pricing Options · Use a website builder – approx. $ to $ per month · Build with WordPress – approx. $11 to $1, upfront, with. Compare all Web hosting plans. ; BASIC. When you just need one site. · 75 · · ; PLUS. Perfect for multiple sites. · 71 · · ; CHOICE PLUS. Get. Meanwhile, a more powerful web hosting service on a cloud server or VPS (virtual private server) infrastructures can cost around $/month or more. At. IIS Hosting. IIS hosting is for running applications or websites that run eumusic.ru eumusic.ru (Microsoft languages) and content management systems like DotNetNuke. DigitalOcean Droplets start at just $4/month and include comprehensive features to support your company's website applications. What kind of web hosting does. Web host B costs $ a month, but you can host unlimited websites, can have unlimited traffic, and it comes with email hosting. What's a better value? Clearly. Use our free trial to start hosting your website or web app with any Google Cloud product. Whisper reduced cloud hosting costs by more than 50%. 5-min.

How Much Is The 2 Dollar Bill Worth

Get the best deals on 2 Dollar Bill Value when you shop the largest online selection at eumusic.ru Free shipping on many items | Browse your favorite brands. Currency in Circulation: Value (in billions of dollars, as of December 31 of each year) Make Full Screen Includes Federal Reserve notes, US notes, and currency. Currency in Circulation: Value (in billions of dollars, as of December 31 of each year) Make Full Screen Includes Federal Reserve notes, US notes, and currency. $2/each, unless red seal (earlier than the 76 bills) or earlier. $2 bills aren't rare, they print tons and tons of them. They're just not used. While you can find a fine-condition coin worth $8, the $2 bills graded at MS 63 are between $20 to $ The rare-condition bank notes still preserve the bill's. If the $2 bill was minted and printed before , it will likely be worth more than its face value on the collectibles market. In some cases. The first $2 notes are Continentals and are over a year older than America. On May 10, , the Continental Congress authorizes issuance of the first $2. The United States two-dollar bill (US$2) is a current denomination of United States currency. A portrait of Thomas Jefferson, the third president of the. The vast majority of $2 bills are worth exactly that: two dollars. This is true for basically all $2 bills printed within the last 50 years. Get the best deals on 2 Dollar Bill Value when you shop the largest online selection at eumusic.ru Free shipping on many items | Browse your favorite brands. Currency in Circulation: Value (in billions of dollars, as of December 31 of each year) Make Full Screen Includes Federal Reserve notes, US notes, and currency. Currency in Circulation: Value (in billions of dollars, as of December 31 of each year) Make Full Screen Includes Federal Reserve notes, US notes, and currency. $2/each, unless red seal (earlier than the 76 bills) or earlier. $2 bills aren't rare, they print tons and tons of them. They're just not used. While you can find a fine-condition coin worth $8, the $2 bills graded at MS 63 are between $20 to $ The rare-condition bank notes still preserve the bill's. If the $2 bill was minted and printed before , it will likely be worth more than its face value on the collectibles market. In some cases. The first $2 notes are Continentals and are over a year older than America. On May 10, , the Continental Congress authorizes issuance of the first $2. The United States two-dollar bill (US$2) is a current denomination of United States currency. A portrait of Thomas Jefferson, the third president of the. The vast majority of $2 bills are worth exactly that: two dollars. This is true for basically all $2 bills printed within the last 50 years.

$2 U.S. TWO DOLLARS ; A, United States Note, Red, $$ $+ ; B, United States Note, Red, $$ $+.

Most of the red seal $2 legal tender notes are worth over $15 in very fine condition. In uncirculated condition the value is around $ The series red. $2 in is the equivalent of $ in , according to the US Inflation Calc. So no, it's not worth more, lol sigh. It only has 18% of. Currency in Circulation: Value. (in billions of dollars, as of December 31 of each year). Make Full Screen. Year, $1, $2, $5, $10, $20, $50, $, $ to. The vast majority of $2 bills are worth exactly that: two dollars. This is true for basically all $2 bills printed within the last 50 years. Find out what a 2 dollar bill is worth with this guide and helpful chart. Do you have a valuable bill in your collection? 2 Dollar Bill Value ; (1 Stack) Crisp UNCIRCULATED $2 Dollar Bills ($ Face Value) year $ · 5 watching ; (1 Stack) Crisp UNCIRCULATED $2. If the $2 bill was minted and printed before , it will likely be worth more than its face value on the collectibles market. In some cases. A circulated C non-star $2 bill in fine or extremely fine condition will be worth between $3 and $7. A star bill in the same kind of shape will be worth. $2 bills account for just % of the value of the $2 trillion worth of currency in circulation. Most $2 bills are worth their face value. Nevertheless, the older and rarer versions can be quite valuable to collectors. At the highest levels, even a one-point grading difference can make a huge difference to value. A non-star $2 bill graded 68 is worth around $ But. Price and other details may vary based on product size and color. The Jefferson Tribute Collection with Rare $2 Bill. More Like This · The. Beautiful 2 Dollar Bill. Reviewed in the United States on August 13, When I was way younger I used to bring many $2 bills back from Las Vegas. I must. US paper currency is worth face value in % of the time, unless it's a truly unusual age, denomination, or has a printing error. Although collectors still seek out many of the uncommon prints, many certificates are only worth their face value. Understanding Silver Certificate Dollar Bills. Series is the final series of red seal $2 notes. The previous series () are only slightly less common. You have go back to the series to find red. The A $2 star notes are worth around $ in very fine condition. In uncirculated condition the price is around $65 for notes with an MS 63 grade. Grading. $2 U.S. TWO DOLLARS ; A, United States Note, Red, $$ $+ ; B, United States Note, Red, $$ $+. If the $2 bill was minted and printed before , it would likely be worth more than its face value on the collectibles market. In some cases, it might be. The stamped notes are not worth much beyond face value, but a collector might seek out a note from their hometown or another location of personal significance.

Sell Crypto Anonymously

#1 Buying BTC at Bitcoin ATMs is Your Best Bet Without a doubt, if you hope to purchase bitcoin as anonymously as possible, you will want to use a bitcoin ATM. Despite Bitcoin's transparency, there are wallets with greater anonymity conditions. You can buy them without them being directly linked to you. But, as. Another way is to use a peer-to-peer bitcoin marketplace that does not require any ID verification from buyers or sellers. At BitFinex you can start trading without identity verification if you only deposit cryptocurrency. ShapeShift. Using ShapeShift you can buy bitcoins (BTC) with. When BTC is bought or sold, the transaction is broadcast to every node and inscribed for-ev-ver on the blockchain. While a public address is unknown to would-be. MEXC is a global crypto exchange without mandatory KYC. Millions of users use MEXC every day to buy, sell, and trade more than cryptocurrencies, and the. Pursa is the best exchange to sell or convert cryptocurrency (Bitcoin, Tether, Ethereum etc) to your local currency anonymously. No registration required. Discover the top platforms and methods for selling cryptocurrency and tokens for dollars while maintaining anonymity. Learn about the importance of privacy. Buy or sell Bitcoin without ID verification. Cash or online. Wondering how to invest in Bitcoin? On AgoraDesk, purchasing bitcoins has never been easier. #1 Buying BTC at Bitcoin ATMs is Your Best Bet Without a doubt, if you hope to purchase bitcoin as anonymously as possible, you will want to use a bitcoin ATM. Despite Bitcoin's transparency, there are wallets with greater anonymity conditions. You can buy them without them being directly linked to you. But, as. Another way is to use a peer-to-peer bitcoin marketplace that does not require any ID verification from buyers or sellers. At BitFinex you can start trading without identity verification if you only deposit cryptocurrency. ShapeShift. Using ShapeShift you can buy bitcoins (BTC) with. When BTC is bought or sold, the transaction is broadcast to every node and inscribed for-ev-ver on the blockchain. While a public address is unknown to would-be. MEXC is a global crypto exchange without mandatory KYC. Millions of users use MEXC every day to buy, sell, and trade more than cryptocurrencies, and the. Pursa is the best exchange to sell or convert cryptocurrency (Bitcoin, Tether, Ethereum etc) to your local currency anonymously. No registration required. Discover the top platforms and methods for selling cryptocurrency and tokens for dollars while maintaining anonymity. Learn about the importance of privacy. Buy or sell Bitcoin without ID verification. Cash or online. Wondering how to invest in Bitcoin? On AgoraDesk, purchasing bitcoins has never been easier.

Anonymous crypto wallets allow users to sell and trade using their wallets without revealing private information about the users or transactions made. Buy and sell Bitcoin, Ethereum, Dogecoin and Litecoin instantly at a Localcoin Bitcoin ATM. + Crypto ATMs across Alberta, British Columbia, New Brunswick. To make cash withdrawals and sell your cryptocurrency, you can follow the prompts on the Bitcoin ATM. The machine will provide a QR code that you can send your. Peach Bitcoin is a **peer-to-peer** mobile app for trading Bitcoin without KYC verification. We **connect** buyers and sellers of Bitcoin in a **secure**. Bitcoin is not anonymous, but pseudonymous. Upvote. Buy and sell Bitcoins anonymously: Short tutorial on cryptoexchanges without ID or limits · [Private video] · Jim Parsons Explains Crypto Currency | Season 31 Ep. Cryptocurrencies, on the other hand, have no intrinsic value. To buy and sell stocks and securities you need to open an account with a brokerage, which means. If you never really sell your Bitcoin, it's possible to be at least mostly anonymous, but the hard part is selling it without giving away your identity. Binance · eToro · Coinmama · Swapzone · CoinSmart; Coingate; Lobstr; Paybis; BitQuick; eumusic.ru; DameCoins; Paxful; eumusic.ru; Bisq. Changelly allows you to buy and sell over cryptocurrencies using MasterCard or VISA card, wire transfer, as well as Google or Apple Pay. It provides a. You can buy or sell your bitcoins in person by setting up a meeting with them. Once you find a buyer or seller, you can make the transfer from your wallet to. There are a variety of peer to peer (P2P) platforms where you can buy Bitcoin or other crypto assets anonymously. Sites like LocalBitcoins, HodlHodl, and Bisq. Best Ways to Buy Bitcoin Anonymously · 1. Peer-to-peer (P2P) marketplaces: · 2. Decentralized exchanges (DEXs): · 3. Bitcoin ATMs. In this article, we will explore why maintaining control over your assets is so important and how anonymously buying crypto, such as Bitcoin, helps to protect. Zcash is proclaimed to be “the most anonymous altcoin” by its creators, since both the amount of crypto paid and its origin are concealed by an encrypted. Using Crypton Exchange, you can anonymously buy and sell Bitcoins, with subsequent exchange or withdrawal of funds. At the same time, all the data of the. The blockchain records the transactions of anonymous traders such that everyone can view them, defying the anonymity of the entire system. The transparency and. Sell. Select currencies. Amount. Fiat Currency. Select Currency. Fiat currency cryptocurrency and buy gift cards with crypto directly from your wallet. Import your bitcoin and connect your bank account. 3. Tap the sell button and follow the instructions. Other options for selling BTC,* include creating an. No, it is not possible to sell Bitcoin anonymously through Anycoin Direct. Identification is required during sales. What does it cost to sell Bitcoin through.

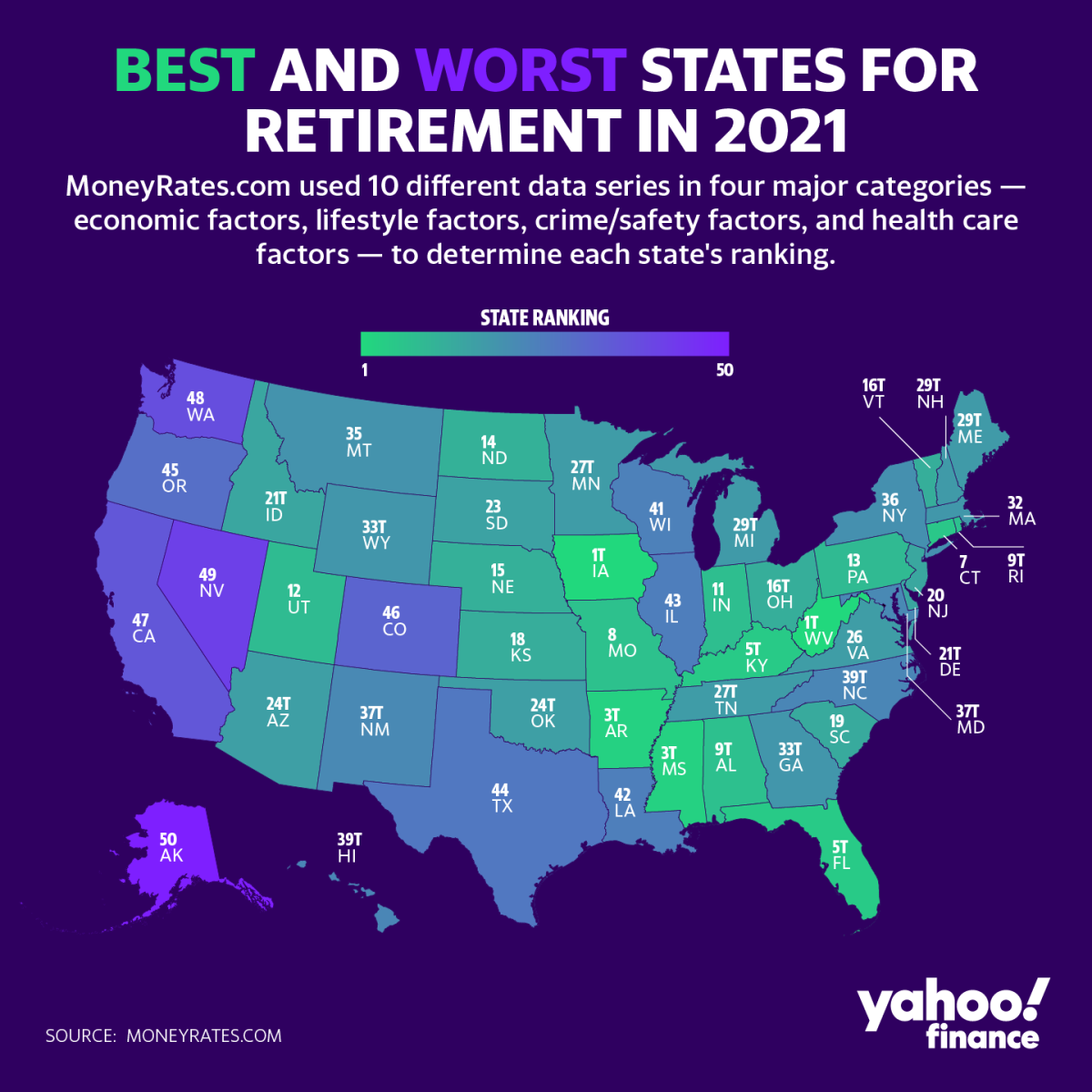

Which States Are The Best To Retire In

MSN's Natalie Moon breaks down a per-state description of the best places for retirees to settle down. Here are Moon's picks. The five states that charge the highest combined (state and local) rates are Tennessee (%), Louisiana (%), Arkansas (%), Washington ( Acts' Best States for Retirement · Alabama: There's no denying that Alabama is a southern state, and that's exactly why many retirees find it so charming. Basically these states have no income tax - Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. After that. The Investopedia Retirement Index combines these three factors, and through this process, Tennessee, Florida, and Wyoming emerge as some of the best states to. 7 Best Places to Retire in the United States · 1. Winston-Salem, North Carolina. Winston-Salem is the perfect destination for retiring on a budget in the US. Best Places to Retire in the U.S. · Harrisburg, PA · Reading, PA · Lancaster, PA · Scranton, PA · Allentown, PA · New York City, NY · York, PA. States like Colorado and North Carolina, known for their four-season climates, offer retirees the best of both worlds: snowy winters perfect for skiing and warm. Mississippi. Of all the states that won't take a cut of traditional retirement income, Mississippi has the lowest property taxes, with a median tax bill. MSN's Natalie Moon breaks down a per-state description of the best places for retirees to settle down. Here are Moon's picks. The five states that charge the highest combined (state and local) rates are Tennessee (%), Louisiana (%), Arkansas (%), Washington ( Acts' Best States for Retirement · Alabama: There's no denying that Alabama is a southern state, and that's exactly why many retirees find it so charming. Basically these states have no income tax - Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. After that. The Investopedia Retirement Index combines these three factors, and through this process, Tennessee, Florida, and Wyoming emerge as some of the best states to. 7 Best Places to Retire in the United States · 1. Winston-Salem, North Carolina. Winston-Salem is the perfect destination for retiring on a budget in the US. Best Places to Retire in the U.S. · Harrisburg, PA · Reading, PA · Lancaster, PA · Scranton, PA · Allentown, PA · New York City, NY · York, PA. States like Colorado and North Carolina, known for their four-season climates, offer retirees the best of both worlds: snowy winters perfect for skiing and warm. Mississippi. Of all the states that won't take a cut of traditional retirement income, Mississippi has the lowest property taxes, with a median tax bill.

Florida reigns supreme as the ultimate retirement destination, offering a trifecta of financial advantages, scenic beauty, and a wealth of recreational. If you want a safe retirement, be aware that Alaska has more than 7 times as much violent crime as Maine, and Louisiana has more than times as much property. Arizona Another Southwestern state tops our list as one of 's most popular destinations for retirees – Arizona. Like New Mexico, Arizona's climate and. Retirement income is fully taxed – with an exception for Social Security benefits – and the Golden State has the highest income tax nationally. High taxes. Let's take a look at some of the best states for retirees, so that you can decide which features appeal to you as you prepare for the “big R.”. 1. Winston-Salem, North Carolina Winston-Salem is the perfect destination for retiring on a budget in the US. Florida is also a popular retirement spot due to its diverse lifestyles. The state offers everything from wildlife and beaches to major cities and theme parks. The best state to retire in for taxes depends on your budget, lifestyle, and values. Find out more about factors retirees should weigh before relocating. 9 states have no income tax. Copy/paste from investopedia: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not levy state. California, Florida, and Texas have the highest numbers of older adults. Wyoming, Delaware, and South Carolina have the most inbound movers citing retirement as. The states with the lowest living costs for retirees include Mississippi, Oklahoma, Kansas, Alabama, and Georgia. Hawaii is considered to be the worst state to retire in. The annual spending for comfortable retirement in Hawaii is the highest of all 50 states at $, 7 Best Places to Retire in the United States · 1. Winston-Salem, North Carolina. Winston-Salem is the perfect destination for retiring on a budget in the US. States such as Florida, Texas, and Nevada are popular choices due to their lack of state income tax and relatively low cost of living. Other options include. US News & World Report released a list of the 10 best states to retire in to determine which are the best for aging, and how well states serve their. The five states that charge the highest combined (state and local) rates are Tennessee (%), Louisiana (%), Arkansas (%), Washington ( Top 5 Best States to Retire in the United States · 5. Colorado · 4. Michigan · 3. Florida · 2. Tennessee · 1. Georgia. The best states for retirement include Florida, Alabama, Wyoming, Nevada, Tennessee, and Hawaii. These states rank highest when you consider factors like taxes. Best Warm States to Retire in the United States · Florida: The Sunshine State · Georgia: Southern Charm and Mild Weather · North Carolina: Balance of Beauty and.

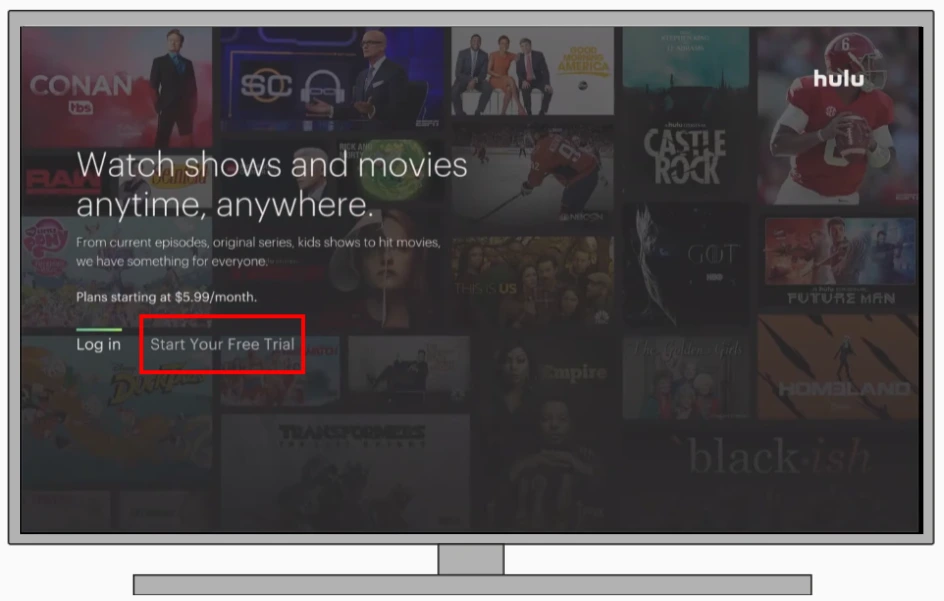

Pay For Hulu Through Amazon

We accept U.S. issued credit and debit cards, digital payment methods, and Hulu gift cards. Most Prime members have a common question: Is Hulu free with Amazon Prime? The simple answer is No. Hulu and Amazon Prime are considered competitors in the. Managing recurring payments. Amazon Pay gives you a single view of all of your recurring payments, in which you can review, modify, and cancel any of them. Tap Activate Hulu (With Ads) during the Disney Bundle enrollment process. · An existing Hulu subscriber - Log in to Hulu using your existing Hulu email and. Sign into Amazon Pay > Select “Check your Amazon Pay orders”. Click To cancel your Hulu subscription through Roku and Sprint, follow these steps. Click here to sign up for Hulu. · Once you've signed up, go to the Home Screen on your Amazon Fire TV. · Launch the app store and search for “Hulu” on your Amazon. Log in to your Account page on a computer or mobile browser and look for the Payment Information section · Select Update Payment next to Payment Method · Add your. If you have an existing Roku account and a supported Roku device, you can choose to pay for Hulu through Roku. Managing an Amazon-billed account. You can connect your Hulu account to your Amazon prime account if you have subscriptions to both. Otherwise no, they're not connected. We accept U.S. issued credit and debit cards, digital payment methods, and Hulu gift cards. Most Prime members have a common question: Is Hulu free with Amazon Prime? The simple answer is No. Hulu and Amazon Prime are considered competitors in the. Managing recurring payments. Amazon Pay gives you a single view of all of your recurring payments, in which you can review, modify, and cancel any of them. Tap Activate Hulu (With Ads) during the Disney Bundle enrollment process. · An existing Hulu subscriber - Log in to Hulu using your existing Hulu email and. Sign into Amazon Pay > Select “Check your Amazon Pay orders”. Click To cancel your Hulu subscription through Roku and Sprint, follow these steps. Click here to sign up for Hulu. · Once you've signed up, go to the Home Screen on your Amazon Fire TV. · Launch the app store and search for “Hulu” on your Amazon. Log in to your Account page on a computer or mobile browser and look for the Payment Information section · Select Update Payment next to Payment Method · Add your. If you have an existing Roku account and a supported Roku device, you can choose to pay for Hulu through Roku. Managing an Amazon-billed account. You can connect your Hulu account to your Amazon prime account if you have subscriptions to both. Otherwise no, they're not connected.

Sidenote: A monthly subscription is $ with commercials, $ with limited commercials, for a total of $/$ per year. This card is worth $ You have the Hulu (With Ads) plan (current reg. price $/month). · You don't have any Hulu Add-ons (e.g. Max). · You currently pay Hulu directly and not. The live streaming service, also referred to as Hulu + Live TV can be watched on users' TV sets through streaming media devices like Amazon Fire Stick. Hulu +. on the back of your gift card. Gift cards and third-party billing. Existing subscribers who pay for Hulu through a third-party other than Amazon or Roku don't. If you create an account on a FireTV (stick or set top box) device, it'll set up Hulu to be billed through "Pay With Amazon." That's the only. Through this trick, Hulu Garment withheld $ million in severance pay owed to the workers. Workers were effectively fired then robbed. “I have two. If your subscription is billed by Hulu, Amazon or Roku, you can review information about past and upcoming charges directly on your Hulu Account page. You can cancel Prime Video Channel subscriptions at any time from the Manage Your Prime Video Channels page in Your Account. New customers can now pay $ a month to watch Amazon's Prime video-streaming service. Previously, the only way to watch Amazon's videos was to pay $99 a. Get unlimited, instant access to a huge streaming library of exclusive past seasons, current episodes, Hulu Originals, hit movies, kids favorites, and more. in the country and the choices are limited to Satellite services. I would rather not pay for the higher packages to have some channels and Hulu Plus gives. Amazon; Apple; Google; Hulu; Max; Roku; Spectrum; Total by Verizon; Verizon; Xfinity. Amazon. You can subscribe to Disney+. Not bad, it's ok. Reviewed in the United States on October 21, Well I pay the extra to not have commercials. But. Cancel your Hulu subscription · Head to your Account page on a computer or mobile browser · Select Cancel under Your Subscription · Next, you may be presented with. You can confirm if you are billed by Apple on your Hulu Account page — your billing party is listed in the Payment Information section. Sign in to Amazon Pay and select “Check your Amazon Pay orders.” · Click on the “Merchants Agreement” tab. · Locate “Manage Merchant Agreements” or “Manage. When you upgrade to the Disney Bundle on eumusic.ru, your first charge will be prorated based on your existing Hulu subscription cost. You will continue to. You cannot access Hulu's content with your Amazon Prime subscription, and vice versa. You have to pay for both services separately if you want to use them both. How do I sign up for annual billing through Hulu? New subscribers can sign up for an annual subscription of Hulu (ad-supported) by visiting eumusic.ru

1 2 3 4 5